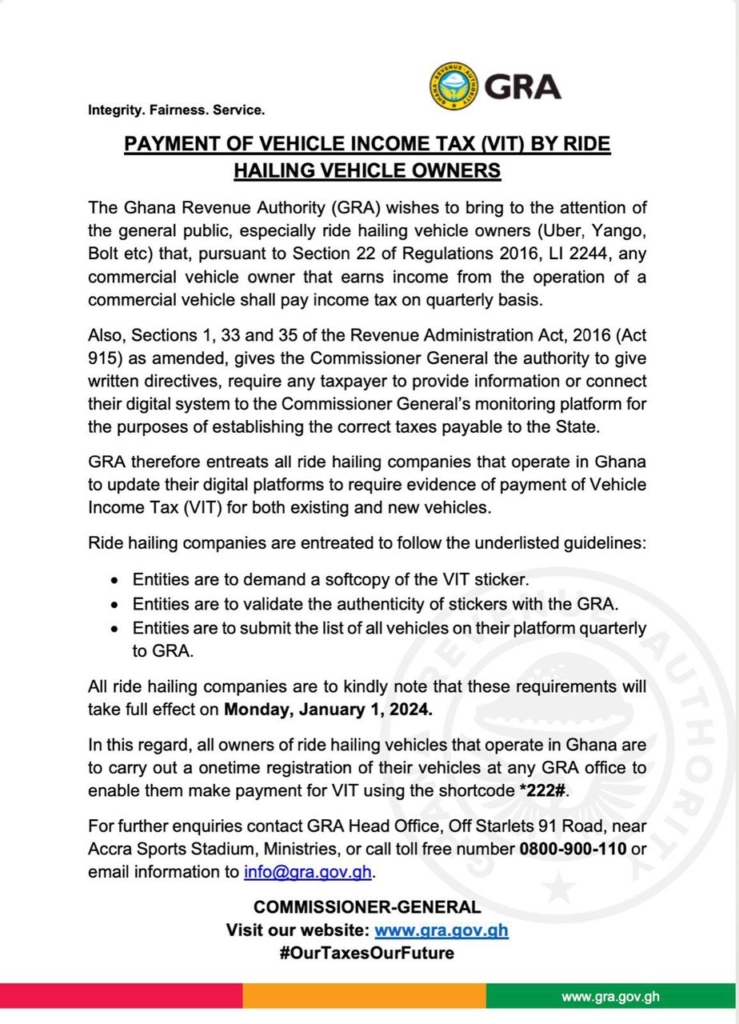

Government through the Ghana Revenue Authority (GRA) will from January 1, 2024, commence the implementation of a new tax policy for ride-hailing vehicle owners of a new tax policy.

Known as the Value Income Tax (VIT) GRA has said it is in accordance with Section 22 of Regulations 2016, LI 2244 which indicates that “any commercial vehicle owner that earns income from the operation of a commercial vehicle shall pay income tax quarterly.”

Ride-hailing companies operating in Ghana; Uber, Yango and Bolt have therefore been advised to update their digital platforms to incorporate the new tax requirements.

In a statement, GRA noted the guidelines include the demand for a soft copy of the VIT sticker, validation of sticker authenticity with the GRA, and quarterly submission of the list of all vehicles on its platform.

Meanwhile, vehicle owners have been directed to register at any of the GRA offices to “enable them to make payment for VIT using the short code *222#.”

ALSO READ:

Read the full statement below: