The recently released Ghana 2023 mid-year Trade Report by the Ghana Statistical Service delves into the intricate landscape of the country’s food product trade, shedding light on key trends, dominant categories, and notable trading partners.

Amidst the diverse array of commodities, food products emerge as a pivotal component of Ghana’s trade dynamics, constituting about one-fourth (23.9%) of total exports in the first half of 2023.

In parallel, imports of food products account for 13.3 per cent of the total, underscoring the significance of food trade in the nation’s economic landscape.

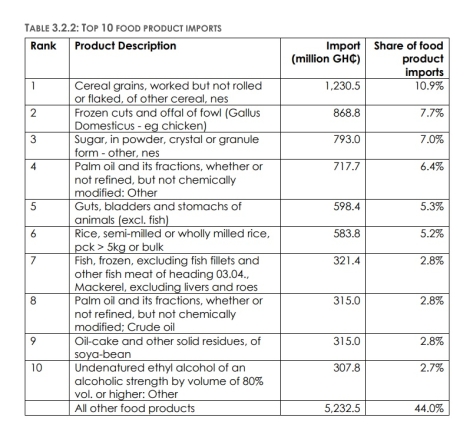

A closer look at food imports reveals a concentration in five distinct categories, with more than half (50.0%) falling into cereals and grains products (22.8%), animal or vegetable fats and oils (12.7%), meat (9.5%), and sugar products (8.6%).

This segmentation provides valuable insights into the composition of Ghana’s food imports, reflecting the diverse culinary needs of the population.

On the export front, a dominant player takes the stage – cocoa products, contributing a substantial 64.9% to all food exports. The report highlights a diversified export destination for cocoa products, while the second most exported food category, edible fruits and nuts, sees major destinations in India (48.4%) and Vietnam (27.1%).

Delving into the granular details of food exports at the 10-digit HS classification level, superior quality raw cocoa beans emerge as the leading export, comprising 42.7% of all food product exports. Following closely are cashew nuts in shell at 11.1%.

Notably, superior quality raw cocoa beans, along with related products such as not-defatted cocoa paste, natural cocoa butter, wholly or partly defatted cocoa paste, and cocoa powder collectively make up over half (56.8%) of all food product exports.

However, on the import side, the complexity of food product trade is distilled into ten specific items, which together represent 56.0% of all food imports. Cereal grains lead the list at 10.9%, followed by frozen cuts and offal of fowl at 7.7%, and sugar at 7.0%.

The report concludes that despite the overall positive trade dynamics, there is a need for strategic planning and policy development, particularly in diversifying food exports beyond cocoa products.

Additionally, recognizing the key players and commodities in food imports can inform trade policies that align with the diverse dietary needs of the Ghanaian population.

As the report provides unprecedented insights, it serves as a valuable resource for policymakers and stakeholders aiming to navigate and optimize Ghana’s food product trade landscape.

Top 10 food imports below;

ALSO READ: