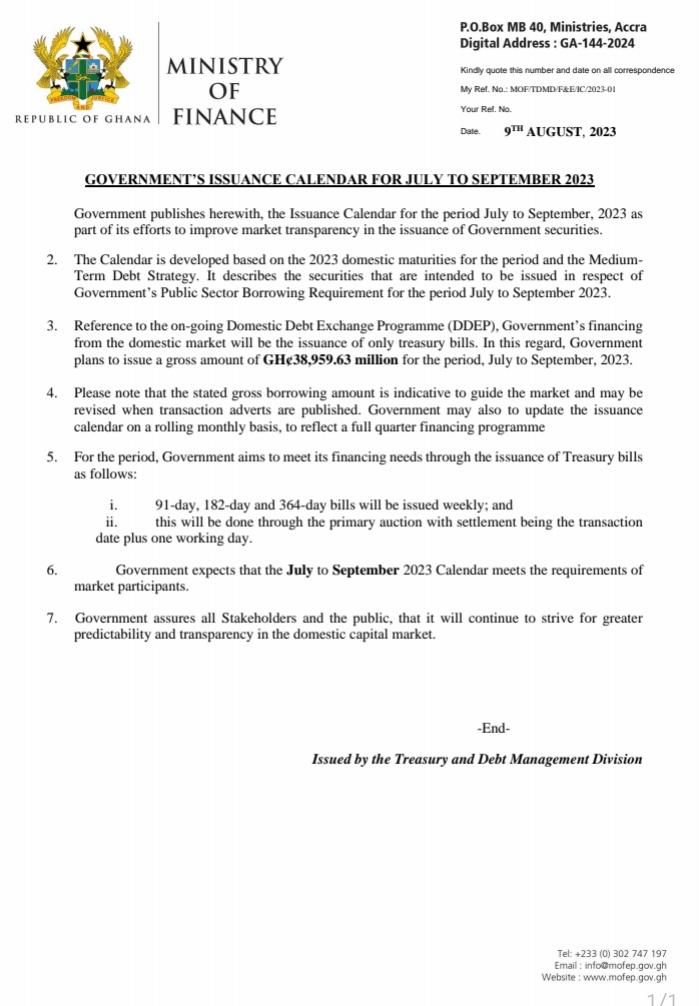

Government will borrow a whopping ¢38.959 billion via treasury bills for the third quarter of 2023.

According to its issuance calendar released by the Ministry of Finance, this will be done via the issuance of the 91-day, 182-day and 364-day bills.

The short term debt instruments will be issued weekly to meet government rising liquidity needs.

Instructively, they will be done through the primary auction with settlement being the transaction date plus one working day.

The government, however, stated that the gross borrowing amount is indicative to guide the market and may be revised when transaction adverts are published. It may also to update the issuance calendar on a rolling monthly basis, to reflect a full quarter financing programme.

It assured all stakeholders and the public that it will continue to strive for greater predictability and transparency in the domestic capital market.

Since October 2022, the government also source of been borrowing has come from the the treasury market due to the economic challenges facing the country.

All financial instruments have been restructured with the exception of T-bills.

In the first four months of 2023, the country’s domestic debt rose by ¢15.7 billion to ¢247.9 billion.

¢3.07bn worth of T-bills to be issued today August 11, 2023

Meanwhile, the government will borrow ¢3.07 billion across the 91-day to the 364-day bills.

This is to refinance ¢2.84 billionn maturing bills.

Analysts say given the relatively larger target size combined with liquidity constraints posed by Bank of Ghana’s Open Market Operations (OMO) bills, yields will likely edge higher this week.

ALSO READ: