The government is capitalising Venture Capital Trust Fund (VCTF) with $40 million to enable it to fund more viable start-ups in the country.

The funding was secured from the World Bank Group (WBG) to help revive the trust fund and strengthen it to provide funding for investors for the transformation of small and medium enterprises (SMEs), especially viable young enterprises.

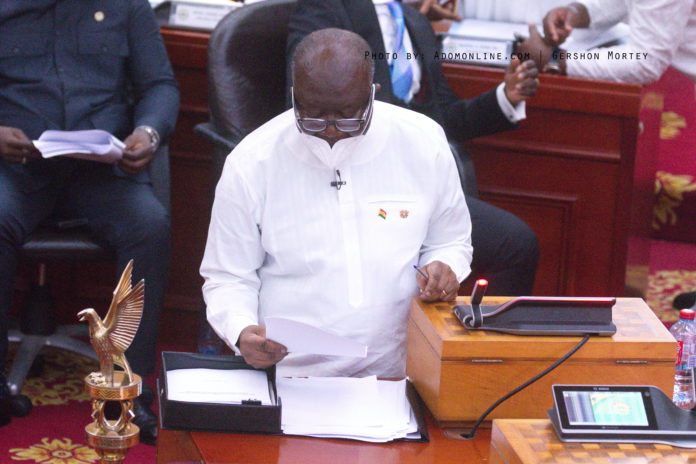

The Minister of Finance, Mr Ken Ofori-Atta, disclosed this when he swore in the Board of Directors of the VCTF in Accra yesterday.

The new board is chaired by Mr Kofi S. Yamoah, the immediate past Managing Director of the Ghana Stock Exchange (GSE).

Dried up capital

Mr Ofori-Atta said the government was aware that the VCTF did not have funds, after its capital was exhausted, hence the decision to recapitalise it.

He said the inauguration of the board had paved the way for the Ministry of Finance to kick-start processes to disburse the funds, which he said represented the government’s commitment to using the venture capital and private equity (VC/PE) model to grow SMEs.

He expressed the confidence that the funds would be available to the fund “in a couple of months” and further challenged the new board to leverage it to attract additional capital.

Board

The eight-member Board of Directors of the VCTF has the Managing Director of the fund, Mr Yaw Owusu-Brempong; a Deputy Minister of Finance, Dr John Kumah; the Chief Executive Officer of the Ghana Enterprises Agency (GEA), Mrs Kosi Yankey-Ayeh, and Mrs Efua Appenteng as members.

The rest are the investment banker and Managing Director of Sentinel Asset Management, Mr Kisseih Antonio; Mrs Mabel Nana Nyarkoah Porbley and Mr Brian Frimpong.

Economic transformation

Mr Ofori-Atta said the VCTF had been made a beneficiary of the government’s Ghana Economic Transformation Project (GETP), an initiative meant to promote private investments and firm growth in non-resource-based sectors of the economy.

“I am also happy to indicate that the VCTF, under the project, is entrusted with the mandate of providing venture financing for early stage businesses and strategic industries with an investment capital of $40 million.

“This is a testament to the government’s firm faith in the potential of the VC/PE ecosystem to lead SME development and build unicorns for the country,” the minister said.

READ ON:

He said the new board was mandated to reposition the VCTF to help increase the total value of investment attracted into the country from the current 22 per cent to 35 per cent, adding that the government had created the enabling environment for the board to succeed in that regard.

Achievements

The minister said since its establishment in 2004, the VCTF had created seven funds, with investments in over 60 companies.

He said the funds were created through leveraging an additional $89.7 million from an invested capital of $29 million.

“Direct sustainable jobs created from these investments are over 3,400, with an additional 13,500 indirect ones. Yet, a lot more can be done,” Mr Ofori-Atta said and charged the board to be innovative in attracting funding to augment that provided by the government.

Priority

The Chairman of the VCTF Board commended the minister for the confidence reposed in the board and pledged to help reposition the VCTF as a growth enabler for SMEs.

Mr Yamoah said capital and corporate governance would be of priority to the board in the drive to build a venture capital fund that could support sustainable economic development.

He expressed optimism that the $40 million capital would be disbursed on time to enable the trust to capitalise on it to support businesses.

Confidence

He said confidence in the fund had returned, following a rigorous clean-up exercise that rid the place of poor corporate governance practices.

Consequently, he said, it was ready for take-off and appealed to the minister to fast-track the disbursement of the funds promised.

He also appealed for a permanent source of funding to ensure a steady flow of capital to the VCTF for optimal impact.