William Owusu Dimitia, a tax expert, has cautioned the government against proposals to increase taxes on the consumption of alcohol and tobacco in the 2020 budget.

READ THIS: 13 Infographics that explain NDC’s reason for ‘NO Vote’ campaign ahead of referendum

“A critical factor in determining the impact or incidence of a tax is knowing the elasticity of the product, government must first do that analysis and get to know the reaction of the ordinary consumers, will the tax get the needed revenue, will it deter them or they will consume anyway?” he said.

He said the government must not rush into implementing the tax increase as a lot of things need to be thought through before an increment in the tax of such products.

SEE ALSO: T.I.’s daughter unfollows him on Twitter following virginity comments

“We need to question ourselves how much are we going to raise from it, because we must put systems in place to enforce this tax, how much is to cost us to put the system in place, will it cause smuggling and cause people to create a black market economy.

“All these are things we need to think through before putting them into action so that we do not implement the policy and not achieve the intended purpose. So instead of rushing to implement the tax increment, let’s take our time and consult the necessary stakeholders and do the real economic tax impact analysis,” he said in an interview with Joy News.

READ THIS: NDC calls for ‘NO’ Vote in impending referendum

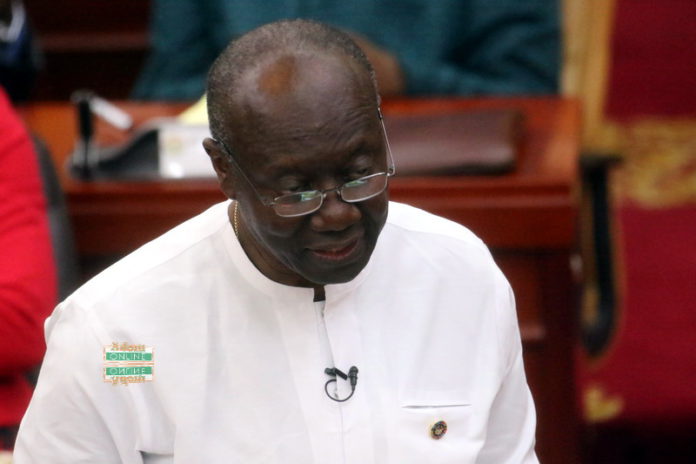

The Finance Minister, Ken Ofori-Atta, is due to present the 2020 budget to Parliament, Wednesday, November 13, 2019.