A member of the ruling New Patriotic Party (NPP) has described government’s debt exchange programme as a ‘necessary evil’.

According to Gabby Otchere-Darko, though the programme will affect individual bondholders, it is a ‘critical’ move which must be implemented by the current NPP administration.

In a tweet on Sunday, he expressed his sympathies with bondholders who are going to suffer as result of the proposed programme.

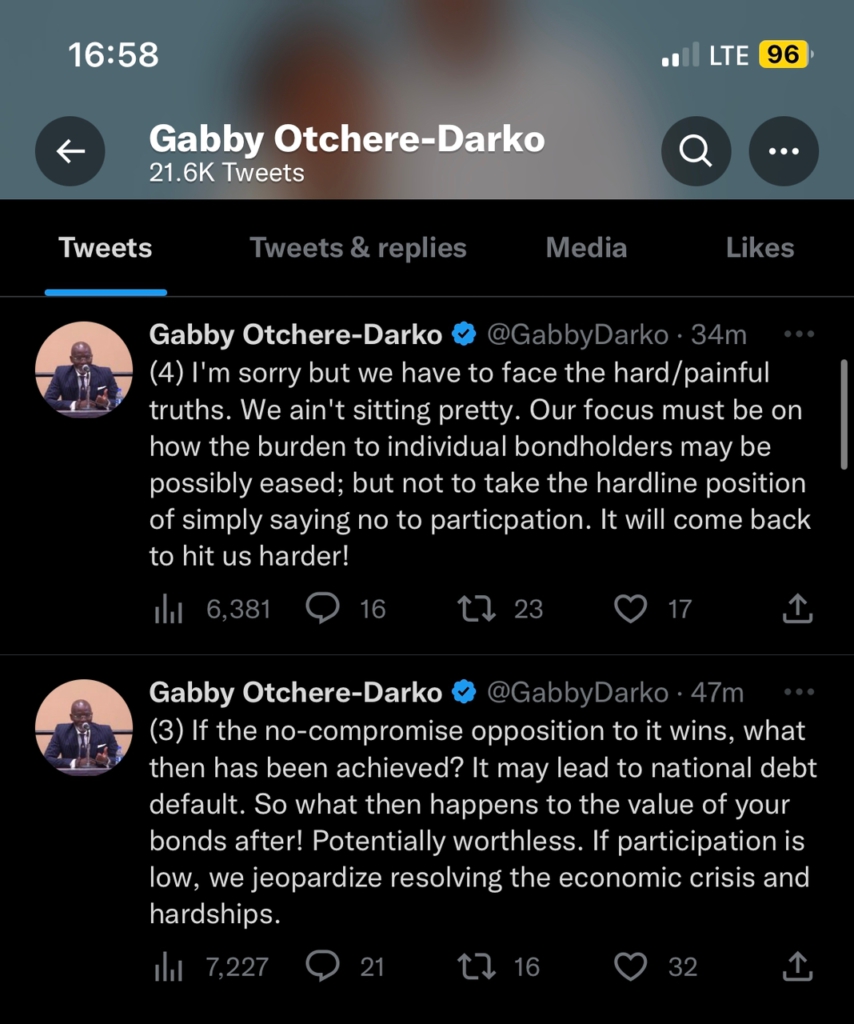

He, however, stressed that if the debt policy is not rolled out, it will plunge the entire economy into danger, hence the need for it to be considered despite the harsh consequences.

“The debt exchange programme is voluntary for individual bondholders but a very necessary evil for our economy,” Mr Otchere-Darko wrote in his tweet.

(2) The debt exchange programme is voluntary for individual bondholders but a very necessary evil for our economy. Its success is critical to restoring macroeconomic stability, securing an IMF prog. It hits those of us holding bonds very hard. A straight no to it is no solution!

— Gabby Otchere-Darko (@GabbyDarko) January 15, 2023

“Its success is critical to restoring macroeconomic stability, securing an IMF programme. It hits those of us holding bonds very hard. A straight no to it is no solution,” the NPP stalwart added.

Having touched on the relevance of the programme, he therefore called on all bondholders to rally behind government in the implementation of the policy.

According to him, if the programme fails to see the light of day, it will affect other macroeconomic variables, including the country’s ongoing bailout negotiations with the International Monetary Fund (IMF).

In concluding his comments on the matter, he said, “I’m sorry but we have to face the hard/painful truths. We ain’t sitting pretty.

“Our focus must be on how the burden to individual bondholders may be possibly eased; but not to take the hardline position of simply saying no to participation. It will come back to hit us harder!”.

(4) I’m sorry but we have to face the hard/painful truths. We ain’t sitting pretty. Our focus must be on how the burden to individual bondholders may be possibly eased; but not to take the hardline position of simply saying no to particpation. It will come back to hit us harder!

— Gabby Otchere-Darko (@GabbyDarko) January 15, 2023

The remarks by the founder of the Danquah Institute comes in the wake of growing public agitations from individual bondholders about government’s proposed domestic debt exchange programme.

In a bid to rescue the economy and secure a deal with the IMF, government has proposed that all bondholders will not receive any interest on their bonds for the 2023 financial year.

The payment of dividends, according to government, is likely to begin next year, 2024 at a discounted rate of 5%.

In relation to this, bondholders who may want to transfer or even forfeit their bonds will not even be able to get the full principal they initially invested as bonds.

This proposal, since its announcement, has been rejected by many bondholders who have subsequently expressed frustration about the development.