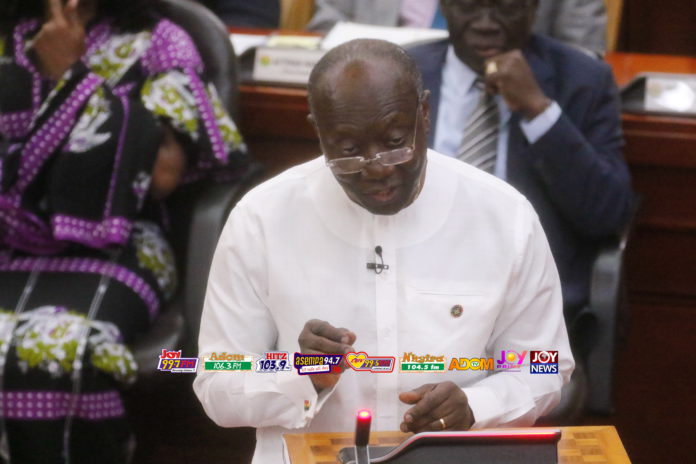

The Minister of Finance, Ken Ofori-Atta, has called for support for the Agyapa Deal to progress instead of it being abandoned.

Responding to a question about the deal at a press briefing in Accra on Thursday May 12, 2022, the Minister described the deal as a “good one” that would help the country to raise resources and reduce its debt exposure.

Justifying the deal, he said: “It is not something that the country needs to drop, that is an asset”.

The question, Mr Ofori-Atta stated, should not be about whether monetising mineral royalties or listing the company was good or bad.

“Rather, if you have a problem with the process, let’s articulate that and cure it. Let’s not drop something that will be good for us and help reduce our debt exposure.”

The discussion, Mr Ofori-Atta said, should be about the processes involved in negotiating a better deal for the country under the Agyapa proposal.

The minister said it was his firm belief that capital markets were fertile sources of equity resources but the country was not leveraging it.

Context

The Minerals Income Investment Fund (MIIF) recently stated that it was developing a new strategy to list Agyapa on the Ghana and London Stock Exchanges by the end of the year.

Mr Ofori-Atta hinted that the deal would be going back to the Office of the Attorney-General and Parliament for consideration.

“We will never have done the Free Senior High School if we listened to other people,” he said, adding that 400,000 people now had a chance to do something with their lives because the government was firm with its decision on the policy.

Background

The government passed the Minerals Income Investment Fund Act, 2018 (Act 978) with the key objective of maximising the county’s mineral wealth for the benefit of Ghanaians, while ensuring that, receiving royalties from gold mining companies is sustainable.

The law was amended to enable the fund to incorporate subsidiaries and use it as a special purpose vehicle (SPV) to do business across the world.

MIIF incorporated Agyapa Royalties Investment Ltd as SPV and holding company to be responsible for managing 75.6 per cent of Ghana’s royalty inflow from the 12 gold mining companies that currently operate in the country.

The SPV, incorporated as a private institution, independent of governmental control, will receive the royalties due the state to capitalise the company.

Agyapa will then float up to 49 per cent on the LSE to be in the business of financing mining infrastructure and assets in Ghana and across the world.

Agyapa, which was initially incorporated as Asaase Royalties, in turn owns ARG Royalties Ltd, which would be responsible for channelling the royalties to its parent company.

Attempts to quote both companies on the Ghana Stock Exchange (GSE) and the London Stock Exchange (LSE) through initial public offering (IPOs) were met with a public outcry, leading to its suspension last year.

But many analysts and political figures have criticised the transaction and alleged that it is meant to allow a few individuals to have control over the country’s mineral royalties for personal gain.

The government has been explaining that apart from the physical benefits such as the proceeds from the transaction, the country will have a very transparent entity and vehicle which could be used to raise future investments for financing mining assets across Africa.

Local small-scale mining companies, the proponents of Agyapa business model believe, can resort to Agyapa for equity financing to bolster the local mining industry to ensure that Ghanaians are also involved in mining activities.