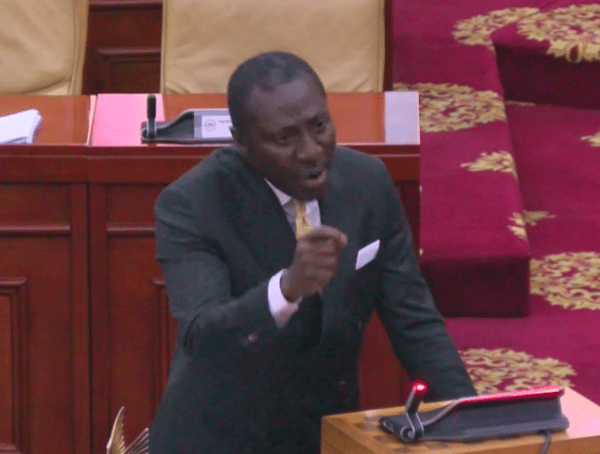

Majority Leader Alexander Afenyo-Markin has refuted claims made by the Minority regarding the government’s tax waiver requests for businesses under the One District One Factory (1D1F) initiative.

Despite facing opposition from the Minority, who expressed concerns about potential corruption and misuse of public funds over the proposed $449 million tax exemptions, Afenyo-Markin defended the initiative during his debate on the State of the Nation Address on Monday, March 11, 2024.

He stressed that tax waivers are designed to stimulate economic growth rather than result in losses for the state.

Afenyo-Markin clarified the rationale behind tax exemptions, explaining that they serve as incentives to attract investments.

He emphasized that these exemptions eventually translate into tax credits, benefiting the state in the long term.

“Tax exemptions are utilized to attract investments, but the NDC is viewing them with a very narrow perspective. Let me elucidate that when a government introduces tax exemptions, it is aimed at fostering economic growth, and consequently, these tax exemptions evolve into tax credits. It’s not without return, so the NDC should not mislead Ghanaians.”

“When a company invests in our country and we waive taxes for the importation of materials and equipment, it essentially means that these waivers eventually become tax credits, resulting in a gain for the state. This is something the NDC failed to accomplish and fails to comprehend.”

ALSO READ:

![“They’ve gone to Jubilee House to look for jobs” – Afenyo-Markin jabs NDC MPs over absenteeism [Video]](https://www.adomonline.com/wp-content/uploads/2025/03/maxresdefault-8-218x150.jpg)