Government is set to streamline Ghana’s tax exemption regime to prevent large companies from abusing it.

With Ghana losing about five per cent of its Gross Domestic Product (GDP) annually due to excesses in taxes of companies operating in the free zone, the government says it is putting in place measures to handle wasteful tax exemptions.

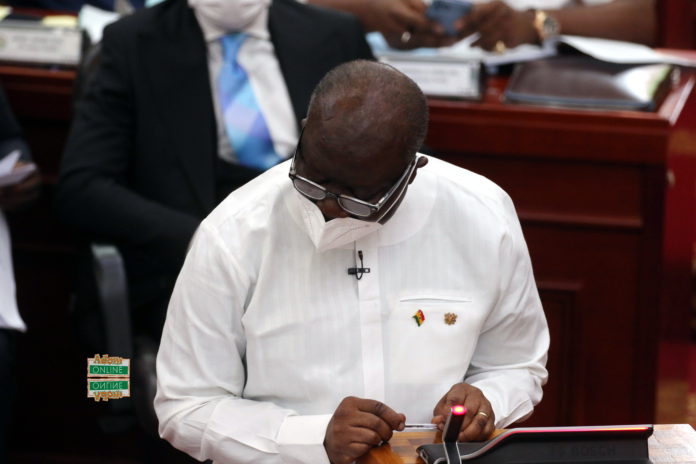

Finance Minister Ken Ofori-Atta, announced this in Parliament while presenting the 2022 Budget presentation on Wednesday, November 17, 2021.

He said government, through the Exemptions Bill which will be laid in the house in 2022, will trim down wasteful tax exemptions to ensure the country gains significant returns from companies enjoying tax exemptions.

“We wish to reiterate that we are in challenging times, which require radical measures, so let us embrace these new policies to enable government to address the fundamental issues affecting the economy, to ensure that, our Nation continues to maintain its position,” he said.

More reliefs for textile industry

The Minister also announced a two-year extension of the Value Added Tax (VAT) relief on African prints for textile manufacturers in the country.

According to him, the extension is to enable them to resuscitate their operations and provide affordable textiles to the market.

Limiting of VAT flat rate to retailers

Mr Ofori-Atta also indicated that the three per cent VAT flat rate on the supply of goods by wholesalers and retailers which was introduced in 2017 will now be limited to only retailers explaining that all other supplies of goods and services will attract the standard rate.

This the Minister explained that the object of the flat rate is to provide a simplified system for small scale enterprises noting that to ensure that this objective is achieved, the rate will be applied to retailers with annual turnover not exceeding ¢500,000.

All other retailers and wholesalers will charge the standard rate.