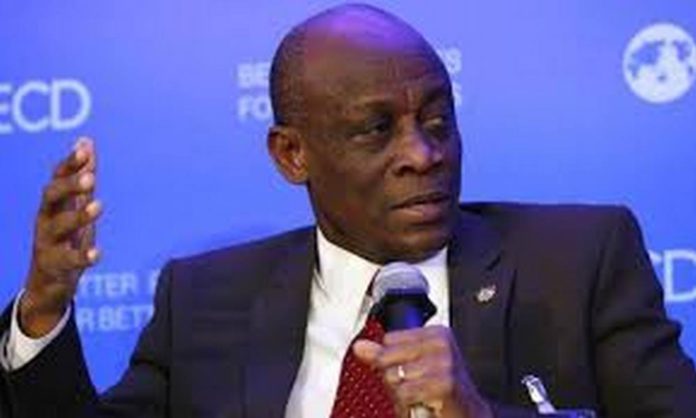

Ghana’s Presidential Advisor on the Economy, Seth Terkper, has called for the establishment of a comprehensive debt repayment mechanism as the government prepares to re-enter both domestic and international capital markets.

Speaking at the Graphic Ecobank Economic Forum in Accra, Mr. Terkper stressed that while the decision to reopen the capital markets—especially the bond market—is timely, it must be anchored on prudent fiscal discipline and a credible debt management strategy to restore investor confidence.

“The discipline is, as I said, if we are going to reintroduce [bonds], we must introduce a debt repayment mechanism,” Terkper said.

He noted that the country’s overreliance on short- to medium-term borrowing instruments like treasury bills and hybrid bonds is unsustainable, particularly for financing long-term development needs. Instead, he suggested aligning capital raising with appropriate investment horizons and ensuring investors, particularly pension funds, are protected through transparent and reliable repayment structures.

“It’s very expensive, borrowing and using treasury bills and those hybrids to build capital to do investment, right? And so, for as long as… pension funds are for long-term investment, and they were putting them into the three-year, five-year bonds, and we were even pushing seven-year, ten-year domestic bonds,” he said.

Terkper’s comments come at a time when Ghana is gradually regaining macroeconomic stability after navigating its way through a domestic debt restructuring and ongoing engagement with the International Monetary Fund (IMF).

The planned re-entry into the capital markets signals renewed optimism about Ghana’s fiscal recovery, but experts caution that success will depend largely on how effectively the government can manage future borrowing and assure lenders of timely repayments.

Source: Winston Tackie