Former Finance Minister, Seth Terkper, has urged parliament to be vigilant and ensure a differentiation is made between the fiscal gap created by the Covid-19 pandemic and the fiscal gap present in the 2020 budget.

The call on Parliament is to separate the two fiscal gaps from each other and help parliament do its due diligence during the mid-year review.

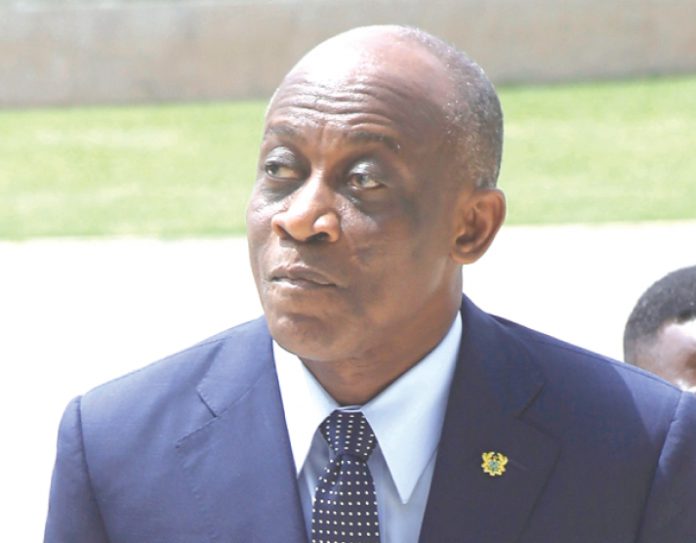

Mr Terkper who is the immediate past Finance Minister under the erstwhile John Mahama Administration in an article titled “PARLIAMENT’S REVIEW MUST SEPARATE 2020 BUDGET AND COVID-19 GAPS”, said his call has been necessitated by observations that the government is using the Covid-19 pandemic as an ‘excuse’ to finance the fiscal gaps present in the 2020 budget.

According to him, the full cost of the fiscal gap presented by Covid-19 has been met through loans received from multilateral and bilateral partners of Ghana (IMF and World Bank) as well as drawdowns from the Stabilization Fund.

He argued in his article that “Parliament should re-examine the revised 2020 Budget and COVID-19 fiscal gaps that it approved to mitigate the effects of the pandemic.

The areas to examine include (a) the use of “offsets” to show a lower fiscal gap for the approval; (b) besides a lower GDP, extra costs that increase the budget deficit materially from Ghc18.89 billion to Ghc 25.1 billion; and (c) since extra COVID-19 costs is funded, reasons for using the virus spread as excuse for Bank of Ghana (BOG) to finance over 50 percent of the disclosed 2020 budget deficit.”

Mr Terkper is of the view that the BoG’s decision to trigger it’s emergency financing provisions in line with Section 30 of the BoG Act, 2002 (Act 612) under the BoG’s Asset Purchase Programme (APP) to purchase government securities worth GHS 10 billion is solely aimed at financing the fiscal gaps present in the 2020 budget.

“It is not transparent to use COVID-19 to resurrect the proposed BOG deficit-financing abolished since 1970s. The IMF and other multilateral/bilateral loans and drawdown from the Stabilization Fund now cover COVID costs. As we noted in past articles, since GOG uses about 98 percent of tax revenues on interest payment and compensation only, it is having financing problems, even without COVID-19.

This article uses the IMF’s Article IV (December 2019) and Rapid Credit Facility (RCF)/COVID (April 2020) Reports to show the original 2020 Budget gap (above fiscal deficit) and the gap relating to COVID19. Table 1 is from the RCF/COVID-19 Report.” He stated.

This comes at a time that the Minister of Finance Ken Ofori-Atta is expected in parliament with the Mid-Year budget review statement which will include full revenues and expenditures of the government in the first of the year.

Also, the Finance Minister will present to the house any reviews in either expenditure or revenues which might be caused by the COVID19.

The overall fiscal gap in the economy we are told is over GHS 48 billion with GHS 9.5 billion fiscal gap created by Covid-19 and a budget deficit of GHS 28 billion. With an excess fiscal gap over GHS 10 billion.