A senior financial lecturer at the University of Ghana Business School, Dr Benjamin Amoah, is calling on the Bank of Ghana to take a more proactive approach in combating illegal financial institutions in the country.

He believes that while the Central Bank is performing well, there is still more that can be done.

In an interview with Nana Osei Ampofo Adjei on The Big Agenda on Adom TV, Dr Amoah emphasised the need for the Bank of Ghana to intensify its investigations in order to shut down unlicensed financial institutions that are exploiting ordinary Ghanaians with enticing interest rates on investments.

“The Central Bank needs to engage in more sensitisation campaigns to help the public understand the operations of these unlicensed financial entities. This way, the public will avoid engaging their services. However, the responsibility does not lie solely with the Bank of Ghana,” Dr Amoah stated.

When asked about other institutions that should contribute to the fight against fraudulent financial activities, Dr Amoah mentioned the Security and Exchange Commission (SEC), the National Insurance Commission (NIC), and the National Pension Regulatory Authority (NPRA). He pointed out that these organisations also have important roles to play in combating fraud in their respective sectors.

Dr Amoah further highlighted the evolving nature of fraud, stating, “Now, fraudsters are shifting from traditional cash-based scams to phone or internet-based fraud, so we also need to be cautious.”

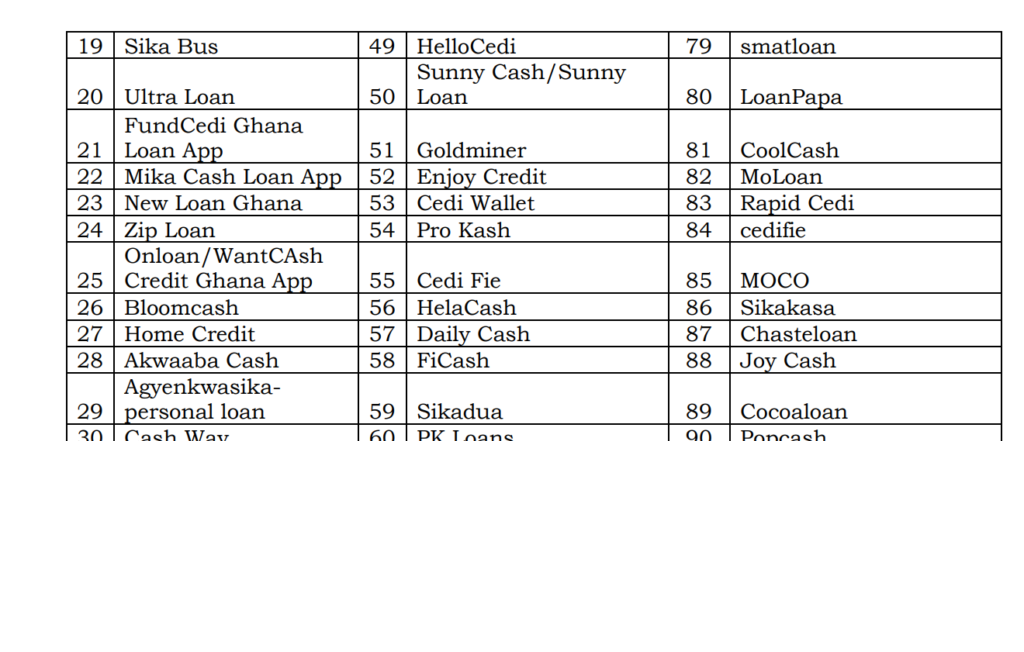

The release of a list by the Bank of Ghana containing 97 unlicensed entities involved in money lending serves as evidence that the Central Bank is actively monitoring and taking action against illegal financial institutions.

However, Dr Amoah stressed the importance of the Bank of Ghana remaining ahead of these fraudsters by increasing their efforts in investigations and public awareness campaigns.

View lists of the institutions mentioned by the central bank