The Bank of Ghana is set to soon close down some Non- Bank Financial Institutions facing severe liquidity challenges.

According to the Central Bank, the liquidity challenges has made it difficult for these institutions to meet financial obligations to their clients and depositors but all attempts by the regulator to keep these institutions in business have proved futile.

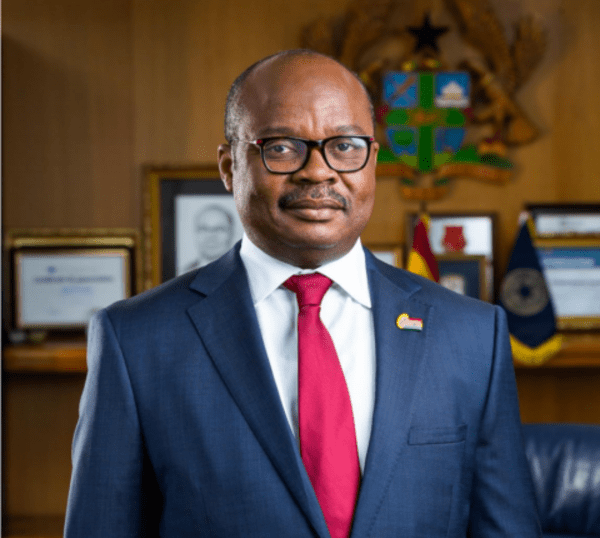

Speaking at the Monetary Policy Committee press briefing, Governor of the Bank of Ghana, Dr. Ernest Addison, said there are still some legacy institutions in the non-banking sector that are not able to meet depositor payments.

“You know that we have some legacy institutions in the non-bank sector that are in a sense not able to meet depositor payments and these are legacy problems.

“We have not been able to raise the necessary resources which would allow those institutions to be resolved and the depositors’ funds returned to them. It’s an issue that we’re looking closely at under this IMF programme”.

The Governor pointed out that some resources would be set aside to take care of the legacy problem.

“The plan is to set aside some resources from the budget hopefully, and once those resources are identified, we will take care of that legacy problem in the non-bank financial institution sector”.

Between 2017 and 2019, the Central Bank undertook a banking reform where several financial players in the Tier 1, 2 and 3 spaces were shut down.

The licenses of 420 financial institutions were revoked in an exercise dubbed the Banking Sector Cleanup.