Africa’s debt sustainability has become a pressing concern, advisory firm Bridgewater Advisors has stated in its Africa Economic Outlook report.

According to the firm, the continent’s public debt surged by a staggering 170% between 2010 and 2024, driven partly by the global financial crises, the COVID-19 pandemic, and geopolitical tensions.

In comparison, global public debt rose by just 54% over the same period. These debt burdens have been further exacerbated by recent exchange rate depreciations, which have significantly increased debt repayment costs.

Compounding the issue, the report said, is an international financial architecture ill-equipped to offer affordable liquidity at scale to close Africa’s developmental gap.

In a bid to turn the tide, African leaders have approved the establishment of the African Financial Stability Mechanism (AFSM), a $20 billion fund hosted by the African Development Bank. The facility aims to avert future debt crises by offering concessional financing to member states that commit to prudent macroeconomic and fiscal reforms.

The AFSM is anticipated to save African countries approximately $20 billion in debt servicing costs by 2035. However, while the AFSM offers a safety net, it is not a definitive solution.

“Achieving lasting debt sustainability will require coordinated action across the continent, anchored in robust macroeconomic management, strengthened fiscal discipline, and improved domestic revenue mobilization,” said Prosper Melomey, Partner, Corporate Transactions & Investment Bank, Africa.

Ghana Recorded $6bn Debt Increase in 2024

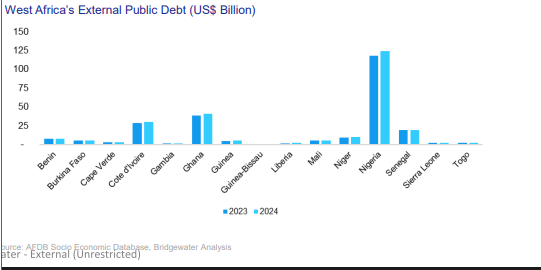

West Africa maintained a stable fiscal position with an external debt-to-GDP ratio of 31%, despite a 5% rise in external funding.

However, Ghana and Nigeria recorded the highest nominal debt increases of $6 billion and $2.5 billion, respectively, in 2024. Nigeria accounted for about 48% of the region’s total external debt.

Bridgewater Advisors noted that Africa’s external debt outlook for 2025–2026 remains high, with Southern Africa expected to see the highest debt levels, rising from 30% to 31%, driven by South Africa’s fiscal pressures and Zambia’s restructuring challenges.

East, North, and West Africa are projected to maintain stable debt levels at 22%, while Central Africa is expected to have the lowest at 3%.

Debt sustainability, the report concludes, remains a concern—especially in high-borrowing regions like Southern Africa.

ALSO READ: