IS DEFICIT FINANCING BACK: BOG 2020 BUDGET DEFICIT SUPPORT AT 53%?

Seth E. Terkper

[Former Minister for Finance]

Introduction

It seems the Bank of Ghana (BOG) May 2020 Monetary Policy Committee (MPC)

Report cites the US Fed and US Treasury to prepare our minds for a significant shift its past

conservative fiscal stance to an aggressive one. COVID-19 is a dangerous health and economic

hazard but the change in BOG’s fiscal stance is stunning, given its record in recent economic

crisis. The Statement includes some bold assertions in Paragraphs 13 to 15:

Preliminary assessments show that the financing gap that was estimated at the time of

applying for the IMF RCF in March (2020) has widened significantly, resulting in a large

residual financing gap.

IMF’s RCF Report shows the COVID-19 fiscal gap as part of a widening 2020 Budget

gap. The Minister went to Parliament in March and May 2020 on COVID-19 but did not present

a Supplementary Budget to differentiate the two gaps. Nonetheless, the Statement is clear:

Current market conditions in the wake of the pandemic, will not allow the financing of

the gap from domestic debt capital markets without significantly increasing interest

rates.

BOG’s justification is a difficult domestic debt capital market condition and significant

increase in interest rates. This is curious and difficult to justify since, as shown in Table 1 later,

GOG’s borrowing from the World Bank, IMF and other sources and its Stabilization Fund draw-

down fully cover the extra COVID-19 expenditures.

Under the circumstances and in line with Section 30 of the BOG Act, 2002 (Act 612), as

amended, the BOG has triggered the emergency financing provisions, which permits the

Bank to increase the limit of BOG’s purchases of government securities in the event of

any emergency to help finance the residual financing gap.

The fact that BOG had to invoke its 2nd level emergency powers to support the Budget

implies that MOF has used its 1st level liquidity access to 5 percent of prior year’s tax revenues (note: the Minister asked Parliament to raise to 10 percent).

Today, under the BOG’s Asset Purchase Programme (APP), the Bank has purchased a

GOG COVID-19 relief bond with a face value of Ghc5.5 billion at the Monetary Policy

Rate with a 10-year tenor and a moratorium of two (2) years (principal and interest).

The Bank stands ready to continue with its APP up to Ghc10 billion in line with the current

estimates of the financing gap from the COVID-19 pandemic.

Without a House approval of a Supplementary Budget and “terms and conditions”,

BOG has already purchased “COVID-19 Relief Bonds”. Given its name, the new GOG bond

gives direct access to “budget” cash, compare with buying existing bonds. Traditionally, central

banks buy existing market instruments during financial crisis because it has a wider impact more holders such as banks and finance houses. On a wider note, the action raises questions on the authority to declare “emergencies”, even if financial: Parliament, Cabinet, MOF or BOG.

Overall versus COVID-19 fiscal gap

BOG’s reversal of a conservative fiscal stance through 2 nd level emergency powers

seems unprecedented but does not differentiate between the 2020 Budget and COVID-19 fiscal

gaps. The Minister informed Parliament that the COVID-19 gap was Ghc9.5 billion, which GOG

can meet from its core COVID-19 inflows, as part of seems to be the approximately Ghc50

billion overall fiscal gap to which BOG appears to show commitment.

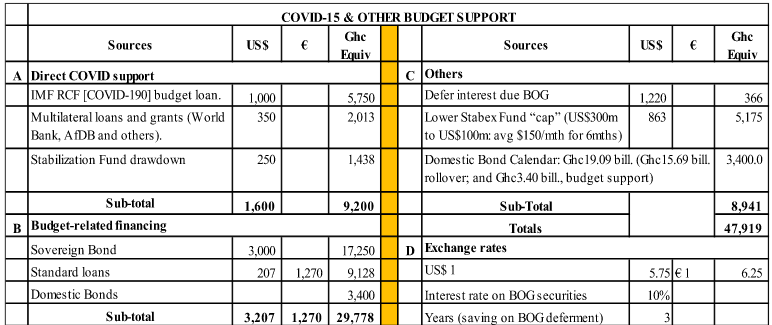

Table 1 shows (a) the COVID-19 Ghc9.51 billion inflows; plus (b) 2020 Budget deficit of

Ghc18.88 billion approved by Parliament; which (c) adds up to Ghc28.49 billion; being (d) far

below the Ghc48.01 billion overall gap and total anticipated inflows.

Table 1: COVID-19 and other Budget support.

The question is if a major fiscal correction is underway to align GOG’s unorthodox

fiscal accounting with that of the IMF and others on the “parallel” reporting saga. The total

funding of gap of US$47.92 billion less Ghc28.49 billion of budget deficit [Ghc 18.88 billion]

plus COVID-19 gap [Ghc9.51 billion]—which implies that the non-COVID correction of

Ghc19.43 billion exceeds the official 2020 Budget deficit of Ghc18.888 billion.

In his May 2020 Statement to Parliament, the Minister asked the House to approve a

“recalibration” of the 2020 Budget to increase the overall fiscal deficit from Ghc18.9

billion (4.7 percent of GDP) to Ghc30.2 billion (7.8 percent of revised GDP).

This level of correction will be consistent with the Fund’s differentiation of RCF

(COVID-19) and overall fiscal gap as well as inclusion of bailout and energy sector costs above

the line—which MOF must show explicitly in the Supplementary Budget, not hidden in budget

footnotes and appendices.

The “recalibration” of 2020 Budget deficit means an adjustment of tax and non-tax

revenues, expenditures, arrears, and financing—a part of the Appropriation process under the

Constitution PFMA. Parliament has approved the 2020 Budget already, hence the Minister must

seek a House approval in a Supplementary Budget. It seems a lot of financing has started before the PFMA’s deadline of end-July for a 2020 Supplementary Budget or Certificate of Urgency.

BOG’s support and commitment

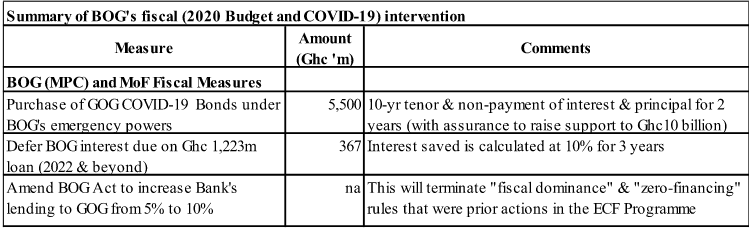

Table 2 shows that the immediate BOG fiscal support of Ghc5.877 billion is 31 percent

of fiscal balance of Ghc18.888 billion in the 2020 Budget, which increases to 53 percent with

escalation BOG support to Ghc10 billion. Given (a) absence of Supplementary Budget; and (b)

RCF, other loans and Stabilization Fund drawdown that appear to cover the COVID-19 needs,

BOG seems to take major decisions on fiscal management that belong to only Parliament.

These include the Appropriation of Public Funds (including BOG funds, as delegated by its Act) that the Constitution (and PFMA) reserves for House under the Constitution and PFMA.

Table 2: BOG’s 2020 Budget and COVID-19 fiscal gap measures

Conclusion

The difference between “COVID-19” and “overall 2020 Budget” fiscal gaps is a source

of concern for observers of Ghana’s fiscal scene. One GOG reputation is its accelerated and

significant fiscal consolidation under an IMF ECF Program from 2017 to 2019. However, come

time to draw on these savings, they seem to fizzle quickly and send GOG scrambling for loans

and debt forgiveness, early in declaring COVID-19 a pandemic.

The IMF’s backdates to revise fiscal balances and public debt figures in the Article IV

(December 2019) and RCF (COVID-19) Board Reports became controversial, as “parallel” and

non-transparent to a section of Ghanaians. Nonetheless, they have helped with a better view of

the fiscal situation. This article highlights the central bank’s apparent role in the fiscal correction (with COVID-19 in the forefront), with the next one giving reasons for why we may be seeing a conservative stance change into an aggressive one.