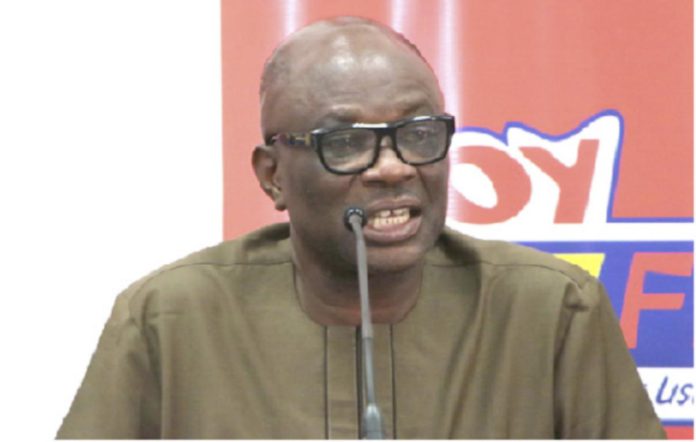

President of the Ghana Union of Traders Association (GUTA), Dr. Joseph Kweku Obeng has described the passage of the three new taxes by Parliament as an “imposition” his union opposes.

To him, government should have addressed the concerns raised by trade unions to reach a concensus before the bills were passed.

Parliament has passed the three tax bills which were tabled before it as part of government’s measures to generate more revenue.

The bills namely the Income Tax Amendment Bill, The Excise Duty Amendment Bill, and the Growth and Sustainability Amendment Bill were passed on Friday, March 31, 2023.

But these taxes, according Mr. Obeng will collapse local businesses and consumers will suffer adverse effects.

“First of all, we do not accept the new taxes they’ve introduced. This is an imposition. The government has no businesses. It generates revenue from taxes from businesses. How can it get the taxes when the businesses are retrogressing? It will not help businesses” he bemoaned.

Dr. Obeng indicated that, the International Monetary Fund (IMF) may recommend that government finds other revenue generation means if the new taxes will collapse businesses.

“IMF does not like businesses collapsing. IMF is interested in countries enhancing revenue collection. So if the IMF realizes that this will collapse businesses, they will ignore government unless there is an alternative solution for revenue generation,” he said on Accra-based Neat FM.

Mr. Obeng added that, if government fails to heed to their concerns about the new taxes just like it did when it introduced E-levy, compliance will be an issue.