The Ghana Union of Traders Associations (GUTA), says it has come to the notice of the members of the trading community that the Ghana Revenue Authority (GRA) intends to increase the benchmark value.

According to GUTA, the use of the benchmark value as a valuation method is illegitimate and contrary to the World Trade Organisation’s (WTO) valuations system.

In this regard, GUTA believes it should not be encouraged in every sense of the word.

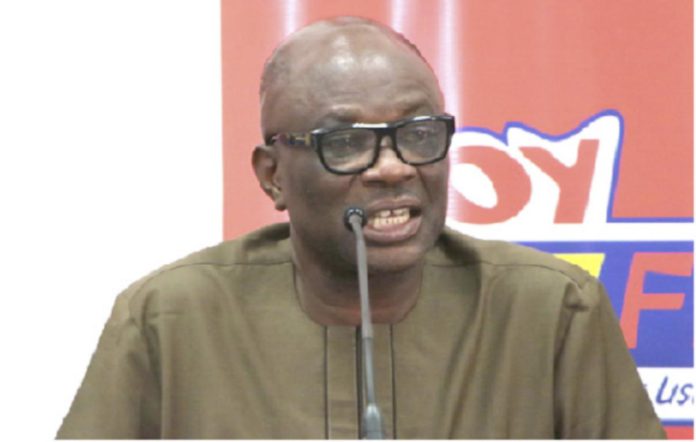

“It should be noted that the introduction of this system by GRA led to an escalation of import duties, which resulted in agitations by the trading public and led to the implementation of the benchmark reduction policy to mitigate the high cost of doing business in the country,” a statement signed by GUTA President, Dr Joseph Obeng reminded.

To GUTA, the benchmark reduction policy has become a topical issue that has not been resolved, so for GRA to bring any increment to aggravate the situation in the country is totally unacceptable.

They have, therefore, appealed to policymakers to stop GRA from what they describe as the abuse of their discretion.

The benchmark value is the reference value for assessing whether a particular declared value that deviated from the benchmark had a valuation risk of under-invoicing, over-invoicing or transfer pricing.

It is, among other things, to stamp out rampant mis-invoicing and valuation fraud and also to ensure that the value of imported goods reflects commercial prices and reality.

The government in its quest to boost the volume of imports through the country’s ports reduced the benchmark values up to 50 per cent in April 2019.

The imposition of the discount policy generated tension between the AGI and GUTA.

The AGI maintained that the reduction in the benchmark values by up to 50 per cent in April 2019 cheapened imports and dampened demand for local substitutes, reducing the rate of growth in the manufacturing sector.

This plea was rejected forcefully at the time by the umbrella body of the trading community, GUTA, which argued that a reversal of the benchmark value would result in increases in the prices of goods.