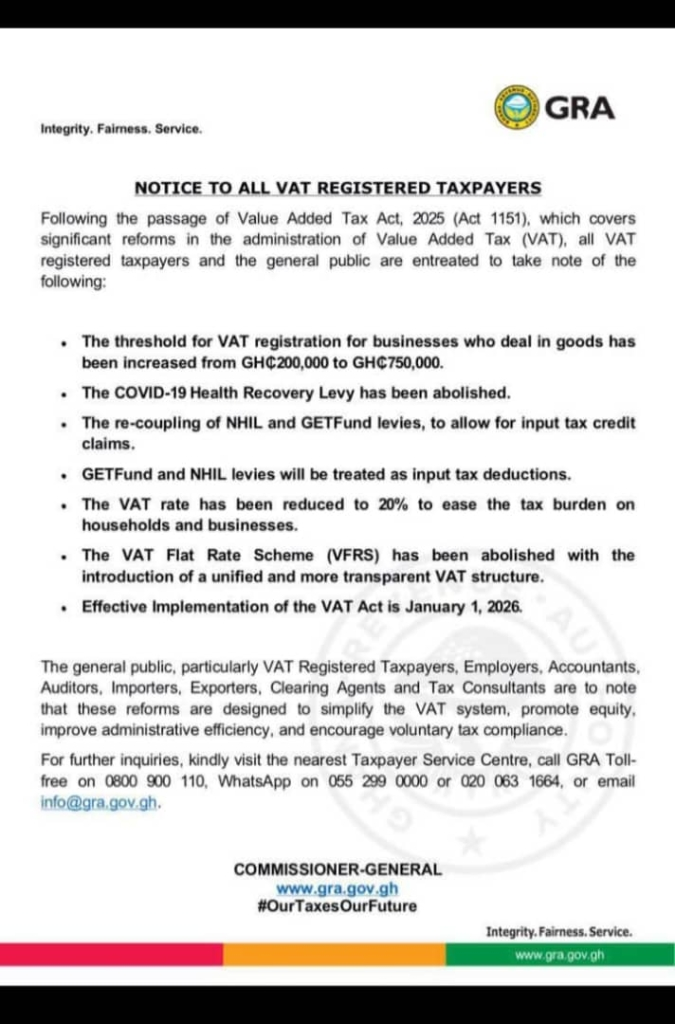

The Ghana Revenue Authority (GRA) has unveiled sweeping reforms to the national Value Added Tax (VAT) system, set to take effect on Jnauary 1, 2026.

The changes include a reduction in the standard VAT rate, higher registration thresholds for small businesses, and the removal of several ancillary levies.

In an official notice to all VAT-registered taxpayers, the GRA confirmed that the standard VAT rate will drop to 20 percent, aimed at reducing the tax burden on households and businesses.

Additionally, the VAT registration threshold for businesses dealing in goods has been increased from GH¢200,000 to GH¢750,000, a move expected to exempt thousands of smaller traders from mandatory registration.

The reforms also abolish certain levies introduced in recent years. The COVID-19 Health Recovery Levy will no longer apply, while the NHIL and GETFund levies will now allow input tax credit claims, providing more transparency and easing compliance.

The VAT Flat Rate Scheme (VFRS) has been discontinued, replaced with a unified VAT structure designed to simplify the system and ensure clarity for all businesses.

The GRA emphasized that the reforms are intended to simplify VAT administration, promote fairness, improve efficiency, and encourage voluntary compliance.

The authority has directed its notice to VAT-registered taxpayers, employers, accountants, auditors, importers, exporters, clearing agents, and tax consultants.

For guidance or questions, the GRA encouraged taxpayers to visit the nearest Taxpayer Service Centre or reach out via their toll-free lines, WhatsApp numbers, or email.

The effective date of implementation is January 1, 2026, marking a significant milestone in Ghana’s ongoing tax and economic reforms.