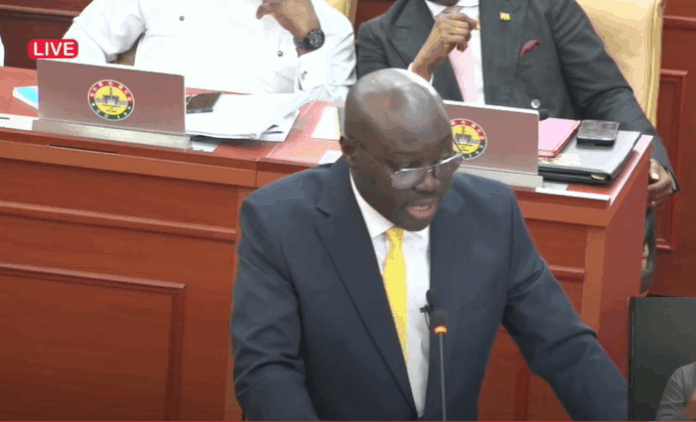

The Minister for Finance, Dr. Cassiel Ato Forson, has disclosed that the government has so far injected a total of GH₵450 million into the National Investment Bank (NIB) as part of a comprehensive effort to revitalise the state-owned financial institution.

According to Dr. Forson, the intervention forms part of a broader strategy aimed at strengthening NIB’s balance sheet and ensuring its long-term sustainability.

“We have invested some 450 million cedis so far into NIB. We have also issued a remarketable bond with a face value of GH₵1.5 billion to NIB and transferred GH₵500 million worth of Government of Ghana’s shares in Nestlé Ghana Limited to the bank,” he revealed.

The Finance Minister further stated that the strategic measures have successfully preserved depositors’ funds amounting to GH₵6.4 billion, safeguarding the interests of customers and reinforcing public confidence in the institution.

The recapitalisation of NIB is part of the government’s broader financial sector reforms, aimed at stabilising the banking sector and positioning state-owned banks to support national development initiatives.

Background

Government early this month said it has recapitalized the National Investment Bank (NIB) with GH₵ 1.4 billion.

This was done in the form of cash and bonds to support the operations of NIB.

The move is part of efforts to restructure the bank and put it on a strong footing going forward.

In addition, government has been forced to fast-track the process as part of the conditions before the International Monetary Fund (IMF) staff takes Ghana’s fourth programme review to the IMF Board for approval.

Before the 2024 elections, the IMF was pushing government to take drastic action on NIB.

There were suggestions that government should move to shut down the bank because it was a drain on government’s finances.

However, the previous administration rejected the suggestion, opting for the injection of new funding into NIB and working with the bank to undertake some serious restructuring and governance reforms.

Myjoyonline

ALSO READ: