Ghana’s energy sector continues to be a black hole for public finances. The 2024 Auditor-General’s report reveals that an overwhelming GH¢15.8 billion, representing 86% of all public financial irregularities, originated from institutions under the Ministry of Energy.

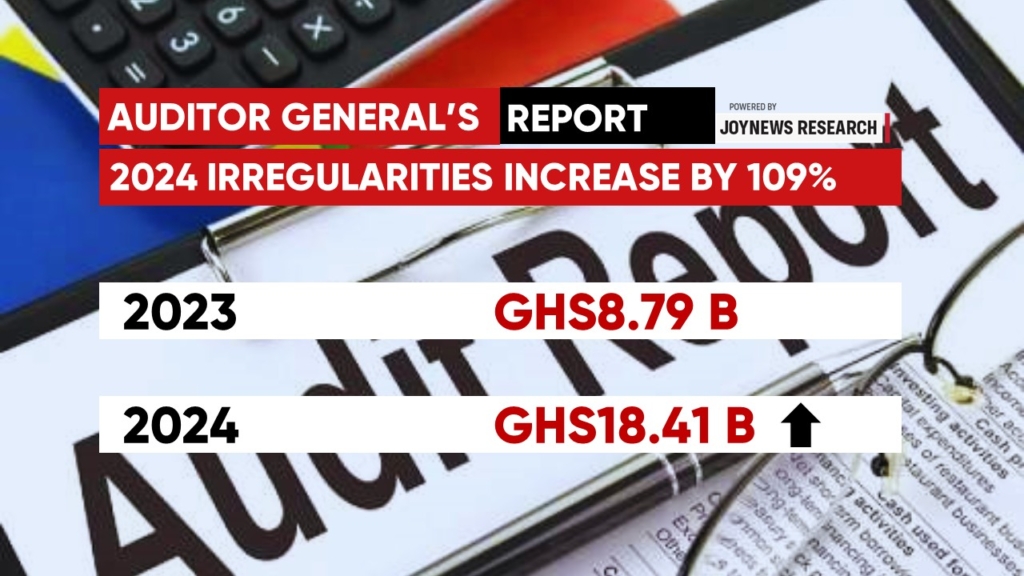

The total irregularities across public boards and statutory bodies stood at GH¢18.4 billion, a figure that has more than doubled from the previous year.

The scale of infractions reflects systemic dysfunction, particularly in revenue reporting, procurement, debt recovery, and contract compliance within the energy sector.

At the core of this is the Electricity Company of Ghana (ECG), whose financial misreporting and weak internal controls accounted for some of the most alarming breaches.

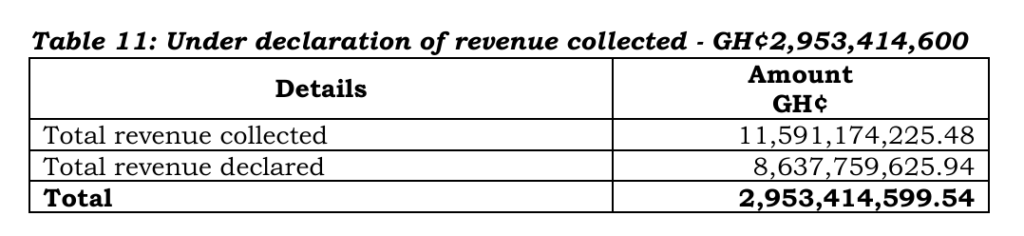

In 2023, ECG under-declared over GH¢2.95 billion in revenue. Instead of disclosing the actual collection of GH¢11.59 billion, the company reported just GH¢8.64 billion to the Ministry of Energy and other relevant authorities.

Even more troubling is its failure to disburse GH¢1.29 billion in collected revenue to state-owned enterprises and Independent Power Producers (IPPs) under the Cash Waterfall Mechanism. These actions, described by the Auditor-General as misleading and unjustified, represent a major breach of public trust and financial transparency.

ECG also defaulted on its tax obligations, withholding but failing to remit GH¢70.9 million in taxes to the Ghana Revenue Authority (GRA). The company’s procurement practices were equally fraught. Instead of purchasing directly from manufacturers, ECG procured materials through intermediaries at an additional cost of over GH¢251 million and paid GH¢75 million to Hubtel Limited for a digital payment platform without a signed contract.

The audit revealed that Hubtel collected over GH¢10.3 billion in revenue on behalf of ECG and deducted its 1.5% commission before depositing the remainder, contravening public financial regulations that require gross collections to be accounted for before deductions. The contract itself, which only came into effect in March 2024 but was backdated to January 2023, was executed without proper procurement clearance from the Public Procurement Authority.

But ECG isn’t alone in this crisis. The Bui Power Authority is still chasing US$729 million in unpaid invoices from ECG, a debt that has steadily worsened since 2020. Despite being owed vast sums, the authority has also failed to service its debt obligations, attracting a loan default penalty of US$846,785. Several livelihood enhancement commitments to resettled communities under its social responsibility programme remain unfulfilled.

At the Bulk Oil Storage and Transportation Company (BOST), the audit found that procurement activities were conducted outside the mandatory Ghana Electronic Procurement System (GHANEPS), undermining transparency and accountability. In addition, the Bolgatanga-Buipe pipelines have been encroached upon by developers, while millions of cedis worth of equipment at depots in Buipe, Akosombo, and Kumasi remain unused. Multiple contracts totalling over US$2 million and GH¢23.5 million were behind schedule at the time of the audit.

The Ghana National Petroleum Corporation (GNPC) was flagged for entering a loan arrangement on behalf of the Ministry of Finance with no formal documentation. The corporation also failed to secure title deeds for a US$6.3 million property it acquired in Tema and continued to publish oil and gas reserves reports without external validation, raising questions about data reliability.

The audit also exposed control lapses at the Ghana Grid Company Limited (GRIDCo), which operates without a comprehensive Environmental, Social, and Governance (ESG) reporting framework, despite the environmental risks of its operations. GRIDCo was advised to align its ESG protocols with global best practices to improve sustainability and accountability.

At the Energy Commission, the misallocation of GH¢120,378 meant for the Energy Fund went unresolved for over two years. Meanwhile, smaller yet notable infractions were recorded at the National Petroleum Authority, Unified Petroleum Price Fund, and Energy Fund, mostly concerning poor documentation, fund misapplication, and compliance failures.

Altogether, the report outlines that of the GH¢18.4 billion in total financial irregularities recorded in 2024, GH¢15.6 billion was classified as recoverable, mostly debts, receivables, and misapplied funds, while GH¢2.8 billion was administrative breaches, including procurement and contract irregularities. The jump from GH¢8.8 billion in 2023 to over GH¢18.41 billion in 2024 reflects a staggering 109.3% increase, driven almost entirely by the energy sector.

These findings arrive at a critical time, as Ghana undertakes a fiscal consolidation programme under the IMF. The Auditor-General has called for the strict enforcement of procurement and financial management laws, sanctions against officials responsible, and urgent reforms across the board.

Without decisive action, the energy sector risks becoming a fiscal time bomb, bleeding the national purse while holding back the country’s development agenda.

Source: Anthony Manu

ALSO READ: