Ghana is likely to end 2025 with an inflation rate in single digits, below the Bank of Ghana’s revised end-2025 target of 12%, Deloitte has predicted in its West Africa Inflation update.

According to the professional services firm, the sustained disinflationary trend gives the Bank of Ghana sufficient headroom to resume its interest rate cuts, which could start at its July MPC meeting.

“An ease in interest rates will encourage more lending to the real sector and support further output and overall economic growth”, it added.

Deloitte continued that the combination of fiscal consolidation and further policy adjustments will ensure a sustained decline in inflation in the second half of the year.

It, however, warned of upside risks including ongoing global shocks and tariff adjustments example, the 2.45% increase in electricity tariffs, resulting in higher production costs and prices of goods and services.

Again, it expressed worry about the implementation of the GH¢1.00 fuel levy on petroleum products, as it described it as another upside risk that could increase fuel and transport costs.

Decline in Inflation Widens Positive Real Return

Ghana’s June 2025 inflation declined to 13.7% from 18.4% in the prior month. This was attributed to lower domestic fuel prices, reduced transport costs, a fall in food prices and the appreciation of the cedi.

The month-on-month inflation moved in tandem with the headline index, recording its first monthly deflation of -1.2% since August 2024.

The food and non-food sub-indices decelerated to 16.3% and 11.4% respectively in the review month.

Deloitte said the further decline in inflation widens the positive real rate of return on investment to 14.3% from 6.2% in June 2024, using the monetary policy rate as a benchmark.

Transport Records Negative Inflation Rate

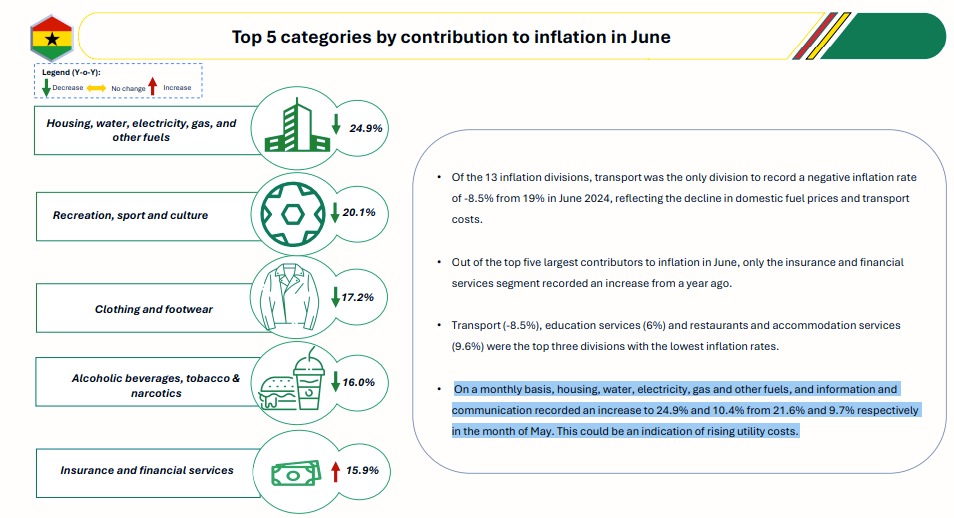

Of the 13 inflation divisions, Transport was the only division to record a negative inflation rate of -8.5% from 19% in June 2024, reflecting the decline in domestic fuel prices and transport costs.

Out of the top five largest contributors to inflation in June, only the insurance and financial services segment recorded an increase from a year ago.

On a monthly basis, housing, water, electricity, gas and other fuels, and information and communication recorded an increase to 24.9% and 10.4% from 21.6% and 9.7% respectively in the month of May. This could be an indication of rising utility costs.

Source : Joy Business