Yesterday, a good friend said to me that NPP cannot expect the bank workers who have lost their jobs as a result of the banking crisis to vote NPP in 2020.

My response was: “I guess it is understandable. But, what about the over one million depositors who would have lost their savings completely had the NPP government not acted against the toxicity that would have eventually overwhelmed the entire industry?”

I think we should tell the story better. GH¢11.2 billion, which was not budgeted for, has been spent to secure the funds of depositors in the collapsed banks. Ironically, the Govt is receiving no applause for this. Note: this amount is more than the $2bn Sinohydro facility that we have praised so much! This is GH¢11.2 billion that could have fixed our roads, schools, drains, health centres, etc. Spare a thought for this Govt for being forced by circumstances not of its own making to spend good money not on its own priority programmes but on others’ negligence and alleged crimes.

The fact that has not been told boldly is that the National Democratic Congress messed up the Banking system. They led the Banking sector to near collapse by creating a laxed system which allowed various unconventional practices in the sector. It is this which is being fixed by the New Patriotic Party and at great cost to you, the taxpayers! Know who to blame and know who to praise!

Specifically, during the NDC regime, according to the evidence, some banks engaged in the following activities which compromised their capital and liquidity, leading to their collapse:

(1) Poor regulation and irresponsible corporate governance practices.

(2) Circumvention of banking laws which resulted in some Banks obtaining licenses under false pretences, false financial reporting as well as insider dealings.

(3) The Bank of Ghana, under the NDC government, effectively condoned under-provisioning and related-party lending to the perverse extent that the bad practice irreparably damaged the capital adequacy for some of the Banks. They were riding on the limited stock of steroids and effectively false pretence.

(4) Non-performing loans were at a record high due to poor lending practices by some of the Banks, worsened by the reckless award of contracts by the NDC, which combined to collapse lending to liquidity problems. Inflated contracts awarded through sole sourcing without any downward price reviews; non-performing loans also increased since Banks were saddled with public sector legacy debts, including a $2.4 billion energy sector legacy debts, to the point that oil trading companies were also collapsing; a calamity that would have eventually affected our capacity as an economy to even import refined petroleum products for essential consumption.

(5) The Bank of Ghana, under the NDC government, tried to sweep the problem under the shredding carpet, and managing the worsening situation by providing liquidity support to these failing Banks in a way which they ought to have known was simply not sustainable. They failed, arguably to the point of criminality, to address the underlying problems that led to the illiquidity and insolvency of these institutions. In short, the financial system had reached a tipping point and was near collapse.

(6) It is as if the NDC and the BoG leadership before 2017 operated with this devious and dubious philosophy: “Let’s stay put! Let’s not touch it because it would cost us to Li much to fix the mess. Let’s pretend the problem does not exist for now, plaster over it and hope that we lose power in 2016 for another Govt to come and struggle to fix it if they can, with all the hassle that comes with it and hope that they will become so unpopular fixing it, with us rubbing it in, that the voting public will turn against them for us who caused the mess to take back power in 2020 after they have fixed it!”

(7) To worsen the situation, Microfinance institutions and Savings and Loans companies were hugely affected due to lack of a comprehensive regulatory framework for those non-bank institutions. This led to the collapse of many microfinance institutions, resulting in Ghanaians losing their hard-earned savings and business capital.

(8) These issues are corroborated and well documented by the International Monetary Fund and World Bank 2015/2016 review as evidenced in their findings and recommendations. Please go and read it. You don’t have to take my word for it. The NDC knew the problem but kept it away from you and pretended all was well.

Now, let us examine the steps undertaken by the NPP to save depositors’ funds and the banking system from collapse.

The NPP government upon assuming office had a banking crisis that they did not create to deal with and quickly had to come up with bold and innovative interventions to restore confidence in the sector and also to protect Ghanaian depositors, businesses and Banks. The Bank of Ghana with the support of the government embarked on a comprehensive and innovative reform agenda with the objective of cleaning up the sector and strengthening the regulatory and supervisory framework for a more resilient banking sector. These are actions of a government that cares about the destiny of the country, the fate of its economy and the wellbeing of the people.

Specifically, the current government undertook the following activities to salvage the situation

(1) The Government and the Bank of Ghana intervened to prevent a banking crisis by initially injecting GH¢11.2 billion of public funds into the financial sector

(2) These measures saved not only the deposits of one million, one hundred and forty-seven thousand, three hundred and sixty-six (1,147,366) Ghanaians and their businesses and the people they employed, but also minimized job losses in the banking sector, as well.

(3) The Government also saved 5 Ghanaian banks that would otherwise have evaporated under the weight of their insolvency, providing, in the process, a backstop guarantee of up to GH¢2 billion.

(4) The current government also took steps to reduce all arrears to contractors. This has helped reduce non-performing loans in the Banks’ books arising from lending to contractors. This means that not all Banks which claim they are being owed by Government may be entirely speaking the truth until they have their claims validated.

(5) The government also took steps to deal with the energy sector debt by using the ESLA PLC to issue energy sector bonds. The proceeds from the issue were used to pay energy sector debts upfront. As a result, Banks were relieved from legacy debts to free up liquidity and capital for investments.

(6) The government developed and used these initiatives to protect jobs, local enterprises, enhance the capacity of local banks and ensure strategic Ghanaian interests in the banking sector.

We should not underrate the monumental rescuing job the NPP has done for the banking sector in Ghana. We will see the benefits for a long time to come.

By the time this entire cleaning up exercise is complete by next year (banks, savings & loans, microfinance and asset management), over GH¢14 billion of your money as Ghanaian taxpayers would have been spent on it!

Just remember that #TheAlternativeIsStillScary

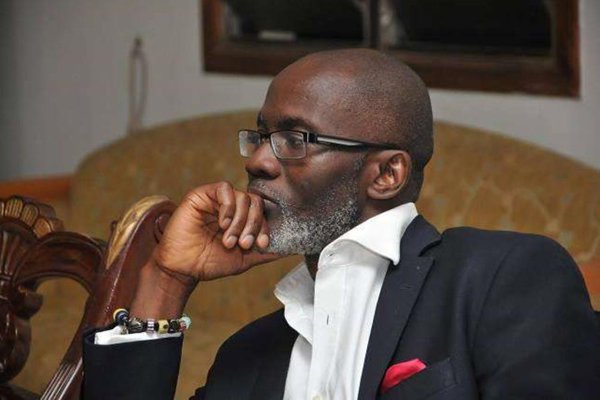

Source: Ghana| Gabby Asare Otchere-Darko