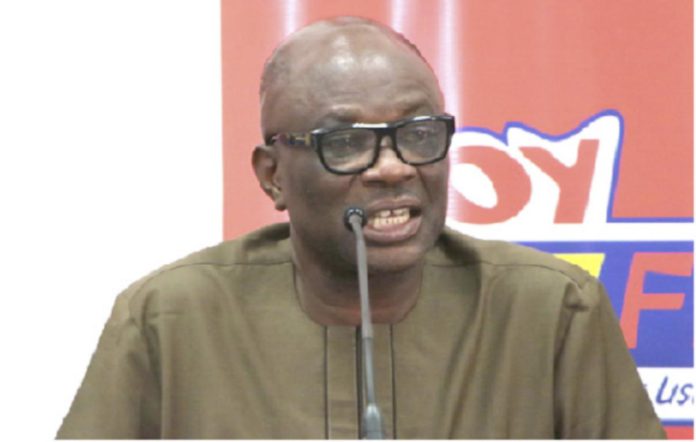

President of the Ghana Union of Traders Association (GUTA), Dr. Joseph Obeng, has reinforced calls by some Ghanaians for government to continuously expand the tax net to rope in more businesses to ensure fairness and parity on taxes in Ghana.

According to him, though there were over 30 million Ghanaians and 13 million potential tax Payers in Ghana, only few of them were captured for paying taxes.

This, according to him, could largely be attributed to the non compliance and lack of affordability by individuals, businesses among others.

He said “There are about 13 million potential tax payers in Ghana, but those who pay are below 5 million with only about 1.2 million people who pay effectively while a lot more people do not pay. Taxes are been recycled among the same people, we will therefore encourage any system that expands the tax net.”

Speaking in an interview with the DAILY GUIDE following the passage of the E-Levy by Parliament last Thursday, he said that though the E-levy was a component of a tax system, it would provide opportunity for lots more people to be captured in the tax regime to increase government revenue for the economy.

The bill initially imposed a 1.7 percent tax on all electronic transactions and money transfers but the rate was reduced to 1.5percent before its passage

He mentioned that the continual tax burden on few businesses could be attributed to the inability of the tax system to identify businesses that do not have physical address locations, hence the move by government to expand the tax net is welcome.

“Once the tax net is broadened it will reduce pressure on importation, traders and corporate Institutions that were already paying tax, but any system that brings innovation for the tax net to be expanded we are all for it,” he stated.

Dr. Obeng further appealed to government to embark on intensive education to explain the modalities for the payment given the kind of businesses some traders are engaged in.

He further added “People are talking about duplication of payment, how will the system ensure people and businesses are not deducted more than once. For any tax system to receive the desired result, it should ensure fairness, parity and should be affordable in order to be accepted by all, any system that brings innovation for the tax net to be expanded we are all for it.

Touching on the president state of the nation address, he said that the President inspired some hope into Ghanaians particularly as he reiterated measures initiated by the Finance Minister to mitigate the economic difficulties businesses coupled with the recent depreciating of the cedi.

He added “what the government did was very encouraging as he appreciated the current economic situation particular the announcement of $12 billion into the economy to help stabilise the cedi. We also appreciate the announcement by government to tax E- Commerce and the ‘no duty no exit policy’ announced by government.”

This, he explained, would prevent abuse ensures fairness and parity in the system.