The Ghana Revenue Authority (GRA) seems to be preparing the grounds for the implementation of the yet-to-be-approved Electronic Transfer Levy (E-Levy).

The tax proposal which is currently in parliament will see the government deduct 1.75% tax on some electronic financial transactions by citizens.

The E-Levy has been the bone of contention since government presented its 2022 Budget statement to the House last year.

According to the Finance Ministry, the move will increase the country’s tax-to-GDP from 13% to a targeted 16% or more and $6.9 billion in revenue.

But the Minority insists that the 1.75% tax is a tool to exacerbate the plight of the ordinary Ghanaian, which the Covid-19 pandemic has already impacted.

A section of the populace and experts have also greeted the yet-to-be approved levy with disapproval.

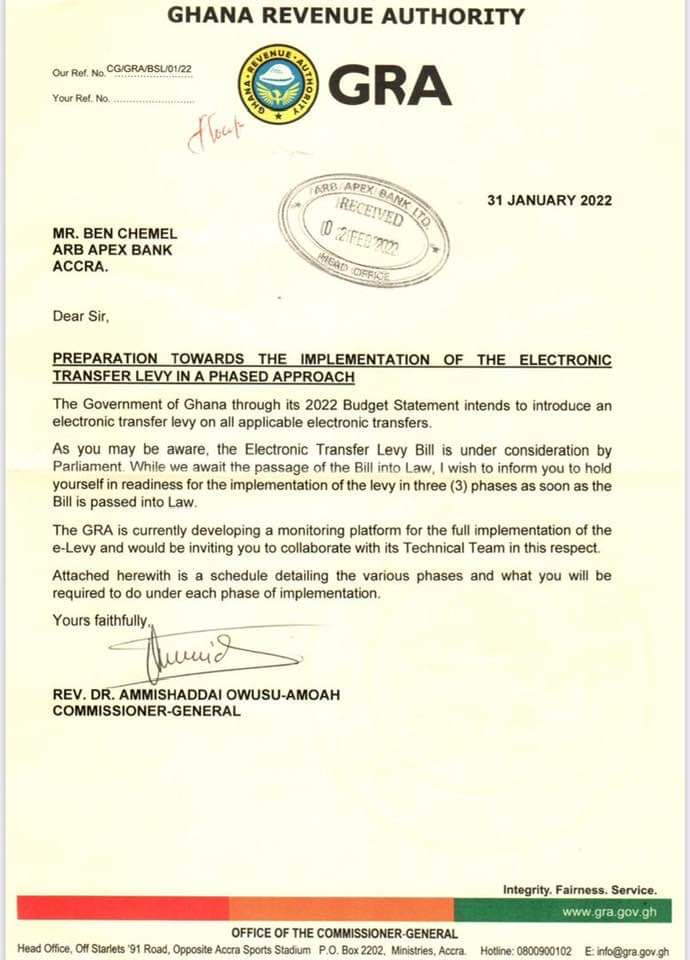

However, ahead of its approval, a letter from the GRA sighted by Adomonline.com is directing partners such as the ARB Apex Bank to trigger processes awaiting the passage of the controversial bill.

The letter signed by Commissioner-General Ammishaddai Owusu-Amoah explained that “While we await the passage of the bill, I wish to inform you to hold yourself in readiness for the implementation of the By in three (3) phases as soon as the Bill is passed into Law,”

The January 31 statement further revealed that the execution will be undertaken in three phases.

This is to enable the GRA to adequately factor the new tax into its revenue collection regime.

The Authority added that it is “currently developing a monitoring platform for the full implementation of the e-levy and would be inviting you to collaborate with its Technical Team in this respect.”

Below is the letter