The Bank of Ghana (BoG) has disclosed that it has incurred billions of cedis in losses under the Domestic Gold Purchase Programme (DGPP) since its launch in June 2021.

According to official data released by the central bank, total net losses from the programme between 2022 and 2024 amount to approximately GH¢7.1 billion. These losses arose from transactions under the Gold for Oil (G4O) and Gold for Reserves (G4R) initiatives.

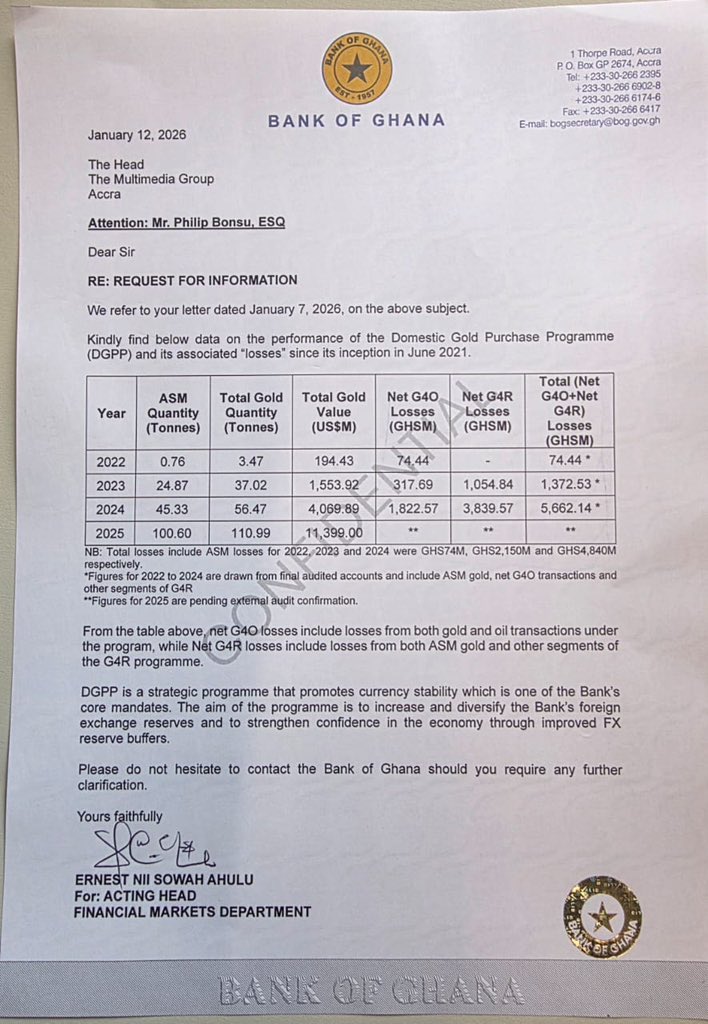

The disclosure was contained in a letter dated January 12, 2026, addressed to the Multimedia Group in response to a request for information on the programme’s performance.

A breakdown of the figures shows that in 2022, the BoG recorded net G4O losses of GH¢74.44 million after purchasing 3.47 tonnes of gold valued at US$194.43 million.

Losses rose sharply in 2023, with the Bank reporting total net losses of GH¢1.37 billion. This comprised GH¢317.69 million in net G4O losses and GH¢1.05 billion in net G4R losses, following gold purchases of 37.02 tonnes valued at US$1.55 billion.

The situation worsened in 2024, when total net losses surged to GH¢5.66 billion. This included GH¢1.82 billion in net G4O losses and GH¢3.84 billion in net G4R losses, with total gold purchases amounting to 56.47 tonnes valued at US$4.07 billion.

For 2025, the Bank reported gold purchases of 110.99 tonnes valued at US$11.4 billion, though loss figures for the year are pending confirmation from an external audit.

The BoG explained that total losses include those from Artisanal and Small-Scale Mining (ASM) gold purchases, with ASM-related losses estimated at GH¢74 million in 2022, GH¢2.15 billion in 2023, and GH¢4.84 billion in 2024.

The central bank clarified that net G4O losses cover transactions involving both gold and oil, while net G4R losses reflect ASM gold purchases and other segments of the Gold for Reserves programme.

Despite the losses, the Bank defended the DGPP, describing it as a strategic intervention aimed at promoting currency stability, strengthening foreign exchange reserves, and boosting confidence in the economy.

“The programme seeks to increase and diversify the Bank’s foreign exchange reserves and improve FX reserve buffers in line with our core mandate,” BoG stated.