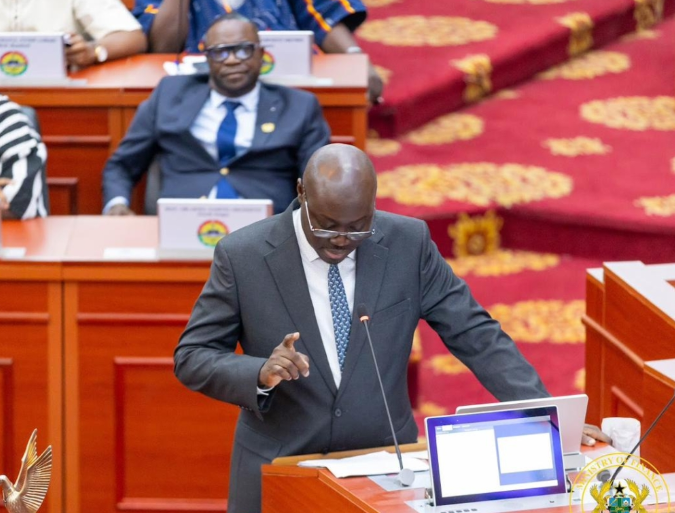

The Minister for Finance, Dr Cassiel Ato Forson, has countered arguments from sections of the opposition that Ghana’s recent credit rating upgrades are simply the result of favourable global commodity prices.

Speaking during the final debate on the 2026 Budget, he clarified that cocoa and gold prices did not surge suddenly in 2025 and were equally strong in 2023.

He noted that despite similar global price conditions in 2023, the economy faltered — the cedi weakened, reserves slipped, inflation escalated, and debt levels rose.

He stressed to Parliament that the contrasting outcomes between both years had little to do with commodities and much to do with the quality of economic management.

The Finance Minister referenced the rating agency Standard & Poor’s (S&P), which directly linked Ghana’s upgrade to improved fiscal discipline, stronger financial buffers and a credible consolidation trajectory.

In his remarks, he pointed out that these developments were policy-driven outcomes and were the result of deliberate strategic decisions by the Mahama-led Administration.

A Home-Grown Stability Strategy

He further addressed suggestions that economic stability only returned because of the International Monetary Fund program.

Dr Forson explained that the government had pursued a homegrown fiscal path anchored in expenditure discipline and protection of citizens from additional tax burdens.

He outlined measures taken to stabilise the macroeconomic environment, including resetting expenditure to 2023 levels, tightening commitment controls, auditing arrears, aligning cash releases to priority spending, and coordinating fiscal and monetary actions.

The Finance Minister maintained that these interventions rebuilt credibility, reinforced confidence in the economy, and contributed significantly to restoring currency stability and investor assurance.

His presentation concluded with the message that Ghana’s economic turnaround was the result of purposeful management, not external conditions.

READ ALSO: