Ghana’s state-owned gold aggregator, GoldBod, is facing growing scrutiny after policy analyst Bright Simons accused the company of concealing critical details about its financial performance and core trading activities.

In a commentary shared on social media, Simons argued that GoldBod’s latest quarterly report fails to disclose the most important metrics expected of a national monopoly overseeing gold purchases in the artisanal and small-scale mining (ASM) sector.

According to him, the report omits essential information such as the total value of gold bought with Bank of Ghana (BoG) funds, the price at which that gold was resold, and the identities of the aggregators and producers involved in the transactions.

Mr Simons said GoldBod’s filing gives the appearance of a mere service provider to the central bank, an arrangement that contradicts the entity’s legal mandate.

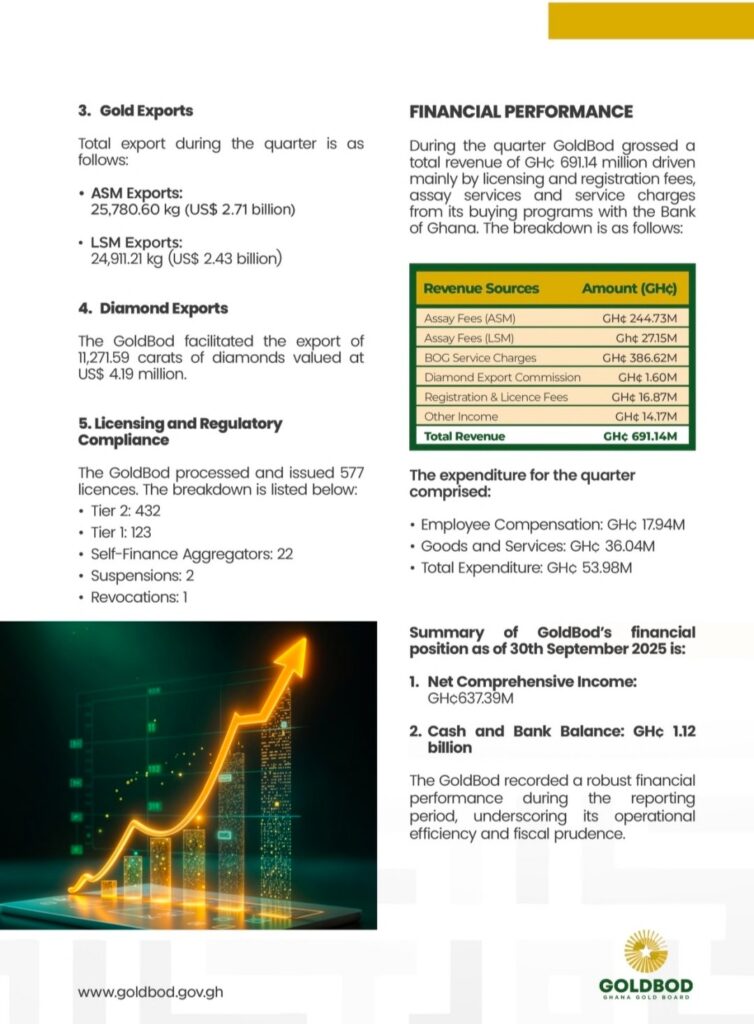

Instead of reporting trade volumes and margins, the company’s document highlights less than $60 million in accumulated fees and provides a bank balance reflecting revenues since inception.

It also avoids disclosing advances received from the Bank of Ghana.

“The core questions remain unanswered,” Simons argued. “How much gold did it buy, with how much money from the BoG? How much was the gold sold for, and to whom? Which aggregators sold to it, and from which mining sites? These are the real performance indicators, not the assay fees charged to producers.”

With the ASM sector contributing a significant share of Ghana’s gold output, GoldBod is expected to serve as a transparent conduit between small producers and national reserves.

Analysts say the company’s reluctance to publish trading margins or counterparties makes it difficult for the public to assess whether the state is receiving fair value from these transactions.

Simons concluded his critique with a call for accountability, insisting that industry stakeholders and the public must demand clarity from the institution’s leadership. “The CEO of GoldBod, Sammy Gyamfi, must be pursued for answers,” he said.

As debate intensifies around transparency in Ghana’s gold value chain, GoldBod is yet to publicly respond to the concerns raised.