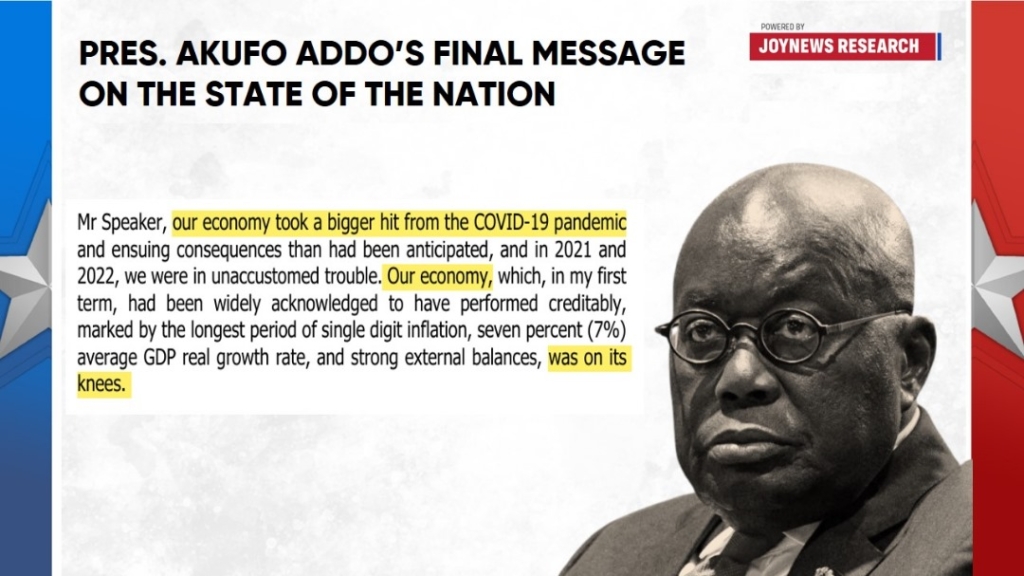

The World Bank has dismissed the Akufo-Addo administration’s long-standing claim that Ghana’s 2022 economic collapse was driven by global shocks, stating instead that the crisis was fundamentally self-inflicted.

In its 2025 Policy Notes on Ghana, the Bank was unequivocal: “The deterioration of global conditions due to the COVID-19 pandemic and the Russian Federation’s invasion of Ukraine was not the cause of the 2022 macroeconomic crisis; rather, it merely exposed an economy already beset with deep structural vulnerabilities and precarious macroeconomic conditions.”

For years, government officials have attributed the severity of the downturn, marked by surging inflation, a free-falling currency, and eventual debt default, to external factors. The World Bank, however, argues that domestic policy failures were decisive.

It points to weak governance, fiscal indiscipline, and delayed reforms, observing that easy access to capital markets and expectations of natural resource windfalls fostered political short-termism, undermined accountability, and weakened the social contract.

The report highlights a recurring pattern of fiscal expansion followed by painful corrections, a cycle that has driven Ghana into 17 separate IMF programs over the past 68 years.

“Sudden macroeconomic stops and crises have led the country to request a record number of IMF programs, remaining under active IMF support for 40 out of its 68 years of history,” the Bank noted.

The human cost has been severe. The Bank estimates that the 2022 crisis and its aftermath pushed more than 800,000 Ghanaians into poverty, with income per capita stagnating around US$2,200 for a decade and poverty now affecting over one-quarter of the population.

Warnings were also issued about renewed fiscal excesses in the 2024 election year. The report cites unbudgeted spending commitments of approximately US$4.8 billion, about 5.7 per cent of GDP, much of it accumulated outside official financial management systems.

“Spending indiscipline poses a critical challenge to Ghana’s macro-fiscal stability… the absence of stringent expenditure controls frequently results in budget overruns and excessive borrowing, undermining efforts to maintain fiscal discipline and compromising long-term sustainability,” the Bank cautioned.

Beyond fiscal mismanagement, chronic inefficiencies in key sectors remain a drag. The energy sector continues to cost about 2 per cent of GDP annually, with arrears mounting despite repeated reform efforts.

Meanwhile, COCOBOD’s debt had ballooned to US$1.8 billion by 2024, with its interventions creating distortions that hurt farmer incentives and undermine overall industry performance.

The World Bank stresses that Ghana now faces a critical juncture. Temporary fixes will not suffice.

“There is an urgent need to signal a clear break from the past and a commitment to change… Success will ultimately be measured by the ability of the government to regain the trust of its citizens.”

Its policy prescriptions are uncompromising: restore fiscal discipline, expand the tax base, reform state-owned enterprises, and strengthen governance.

Without decisive action, the Bank warns, Ghana risks remaining locked in the destructive cycle of crisis and bailout that has defined much of its post-independence economic history.

Source: Anthony Manu| Data and Research Analyst @ JoyNews Research