The Ghana Anti-Corruption Coalition (GACC) has assessed the misreporting of Ghana’s debt, warning that inflated debt figures could mask corruption and lead to debt servicing of non-existent creditors.

The Coalition is raising alarm over the risk of inflating debt levels after the disclosures by the Auditor-General on Ghana’s overstated 2024 public debt of over 18.8%.

The coalition is calling for urgent investigations to expose the root causes and ensure transparent and accountable debt management.

The 2024 Auditor‑General’s Report revealed that Ghana’s public debt was overstated by GH¢138.91 billion, with the Controller and Accountant‑General’s Department (CAGD) reporting GH¢876.08 billion, while the Ministry of Finance’s records show just GH¢737.17 billion.

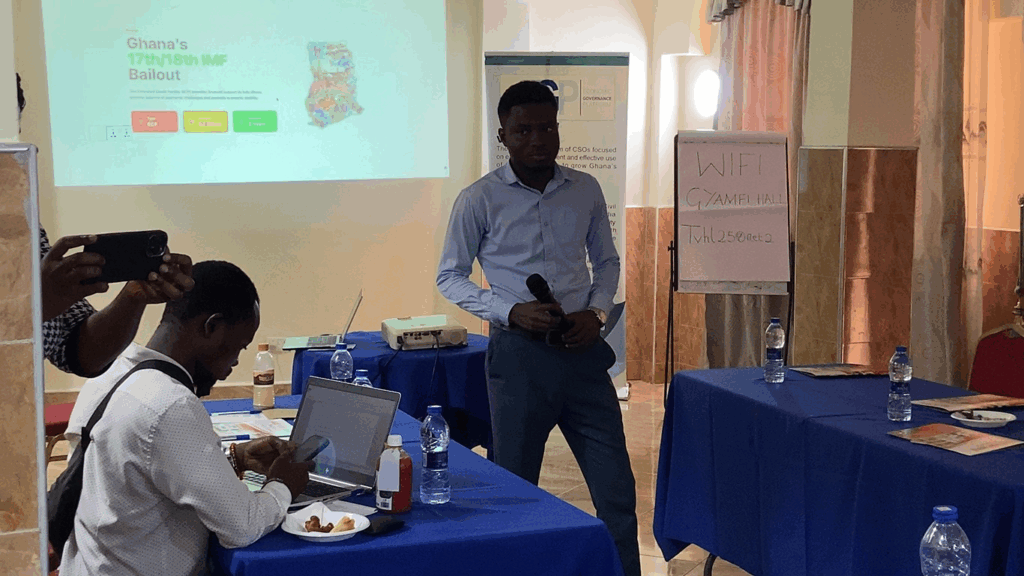

Coordinator of the Economic Governance Platform, Abdulkarim Mohammed, says misreported national debt disguises corruption and leads to servicing non-existing debt.

“We realized that some aspect of our debt is not being captured properly. And in terms of the over statement disclosed by the Auditor general, it may on the surface be a positive signal, but there is a very high risk of over-stating debt.

“It means that you may be servicing debt that may be non-existent and crediting non-existing creditors. And this could be a source of siphoning state funds to services rather than rescuing the nation from our debt. We need to assess what accounted for such, and deal with it,” he said.

He was speaking at the launch of a report on Sustainable Debt Management in Ghana by the Economic Governance Platform hosted by GACC, with the aim of engaging stakeholders and addressing Ghana’s unsustainable debt trajectory.

With Ghana currently undergoing debt restructuring under an IMF-supported programme, the report arrives at a critical time and seeks to reform how Ghana amasses, manages, and reports its public debt.

“We have narrowed down the issue of debt being a constant feature. We believe if we are able to sustainably manage our debt, we won’t have to always be involved in the cyclical trend of running to the IMF,” Abdulkarim Mohammed said.

The comprehensive study consolidates expert insights with the expectation to serve as a critical resource for policymakers, civil society, and development partners committed to Ghana’s economic resilience.

Abdulkarim Mohammed explained that the study focuses on three critical areas, political economy, legal and institutional frameworks, and fiscal transparency.

“Unsustainable debt has become a key feature in all of the economic crises we have faced leading to the IMF bailouts over the years. The first pillar is the political economy of data acquisition and accumulation in Ghana. Debt management with focus on institutional legal framework.

“Debt transparency, thus how debt is communicated and reported. The findings from these studies is what we have put together in the sustainable debt management report,” he said.

The Economic Governance Platform also raised concerns about bloating debt during election period.

This has been assessed as financial indiscipline, with Ghana’s debt caught in a cycle of debt recovery and falling back.

“We tend to over-spend our budget during election years, far above deficit targets, and this becomes a burden after elections. And the new government now has a duty to clean up that mess.

“We are always in a cycle of falling into a debt crisis and going for a bailout, recovering, and falling back in again. Until these issues are taken seriously, we won’t solve any problem,” he said.

The report forms part of the Citizen Action for Sustainable Debt Management Project, supported by the Open Society Foundations (OSF).

Source: Clinton Yeboah

ALSO READ: