Engineers & Planners (E&P), the Ghanaian firm at the center of a gold mine acquisition, has clarified what it calls “misleading and false claims” regarding its purchase of Azumah Resources Ghana Ltd, a gold concession in the Upper West Region formerly owned by Australian interests.

In a statement issued on Tuesday, July 8, detailing the legal battles surrounding the acquisition, E&P revealed that it entered into a $100 million agreement with Azumah’s shareholders on October 9, 2023, months before Ghana’s 2024 general elections.

The company insisted that all key milestones, including the agreement to buy the project and an offer letter from the ECOWAS Bank for Investment and Development (EBID) to finance it, occurred prior to the elections.

“Let the record show, the acquisition contract was signed in October 2023 at our Roman Ridge offices in Accra, with payments scheduled in two equal parts,” part of the statement read.

“Claims that this is a post-election arrangement or politically motivated are completely false.”

Azumah Resources had held the gold lease since 1992 but failed to commence any significant operations over a 30-year period. By 2022, the company owed the Ghana Revenue Authority and the Minerals Commission over $5 million.

Facing court judgments and low gold prices, its Australian shareholders offered to sell the asset to E&P for $100 million, a move they hoped would shift financial and legal risks to the new owner.

Despite Azumah’s liabilities and instability in neighbouring Burkina Faso, E&P accepted the offer and began funding operations in November 2023, averaging $500,000 in monthly operational support.

In August 2024, Azumah Director James Wallbank sought to triple the price to $300 million, citing a global surge in gold prices.

However, E&P rejected the demand and initiated arbitration and legal action to enforce the original deal.

In June 2025, the High Court ruled in E&P’s favour, ordering the status quo to be maintained and effectively nullifying Azumah’s unilateral attempt to terminate the contract.

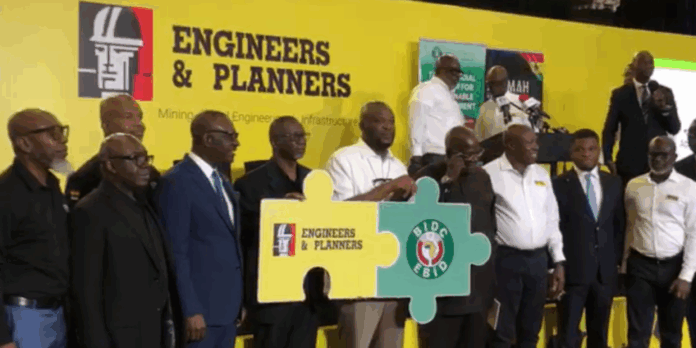

E&P also secured a $100 million acquisition loan from EBID to complete the purchase, culminating in the official facility signing ceremony on Monday, July 7, 2025.

The ceremony was attended by Azumah’s resident directors, though the Australian shareholders were notably absent.

E&P categorically dismissed media allegations suggesting political influence or improper government involvement.

“No government official or appointee influenced this transaction in any way,” the company asserted. “This is a pure, arm’s-length commercial deal.”

They also explained that the July 7 ceremony involved the borrower (E&P) and lender (EBID), not Azumah, and that the dissociation letters being circulated have no bearing on the legal status of the acquisition.

E&P further stated that it has received a no-objection letter from the Minerals Commission to proceed with the mine’s development and aims to commence gold production within 36 months.

“This is the first time a wholly-owned Ghanaian company has acquired a large-scale mine,” the statement noted. “We urge Ghanaians to rally behind this national milestone rather than allow mercenaries to derail it for personal gain.”

Source: Prince Adu-Owusu