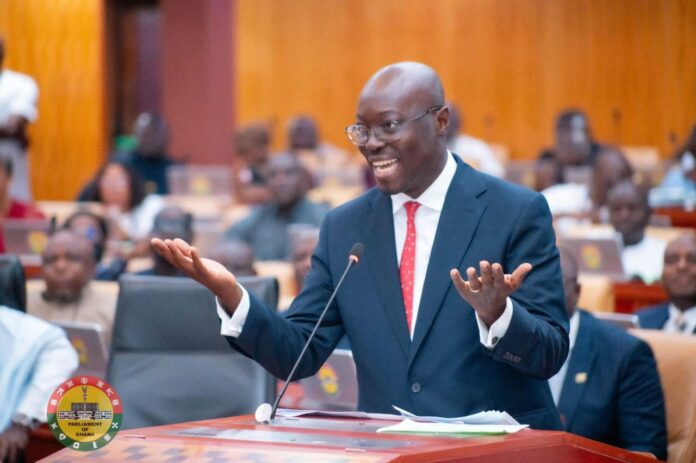

Finance Minister Dr Cassiel Ato Forson has sparked controversy in Parliament with the introduction of the Energy Sector Levy (Amendment) Bill under a certificate of urgency, seeking to impose new taxes on petroleum products.

The bill, if approved, will introduce fresh levies on all petroleum products. Dr Forson explained that the measure is necessary to clear an alarming US$3.1 billion energy sector debt as of the end of March 2025.

Addressing Parliament on Monday, June 3, the Finance Minister assured that, despite the tax increment, consumers would not immediately feel the impact at the pumps. He attributed this cushioning effect to the robust performance of the Ghana Cedi.

Dr Forson outlined the dire financial condition of the energy sector, noting that the US$3.1 billion debt includes substantial arrears owed to Independent Power Producers (IPPs), various State-Owned Enterprises (SOEs), and key fuel suppliers.

He identified non-payment of bills to power providers such as ENI and Karpowership as a major contributor to the crisis. These lapses, he said, led to the complete drawdown of a US$512 million World Bank IDA guarantee and a US$120 million GNPC guarantee in 2024. The government now requires an additional US$632 million to restore these critical guarantees.

“To help raise additional revenue to fund the needs in the power sector, the government is proposing an increase in the ex-pump price of petrol, diesel and related products,” Dr Forson told Parliament.

However, he moved quickly to allay fears of immediate cost escalation.

“Mr Speaker, I repeat,” he emphasised, “the impact will be absorbed by the gains made from the strong performance of the Ghana Cedi, and this will mean that consumers will not have to pay extra for the price of petrol and diesel beginning today.”

He added, “Our simulations suggest that there will be no increase in the ex-pump price of petrol and diesel in the next window beginning today if the levy is imposed. This is because of a strong Ghana Cedi.”

Dr Forson explained that the proposed levy would serve as a dedicated source of funding for the struggling power sector. Proceeds will be earmarked specifically for the procurement of fuel needed to ensure uninterrupted power generation.

This, he argued, is essential to guaranteeing a stable electricity supply, noting that “the current electricity tariffs paid by consumers do not include the cost of fuel used for power generation.”

According to him, the decision to impose the levy reflects a strategic effort to balance the need for reliable electricity with the long-term financial sustainability of Ghana’s energy sector.