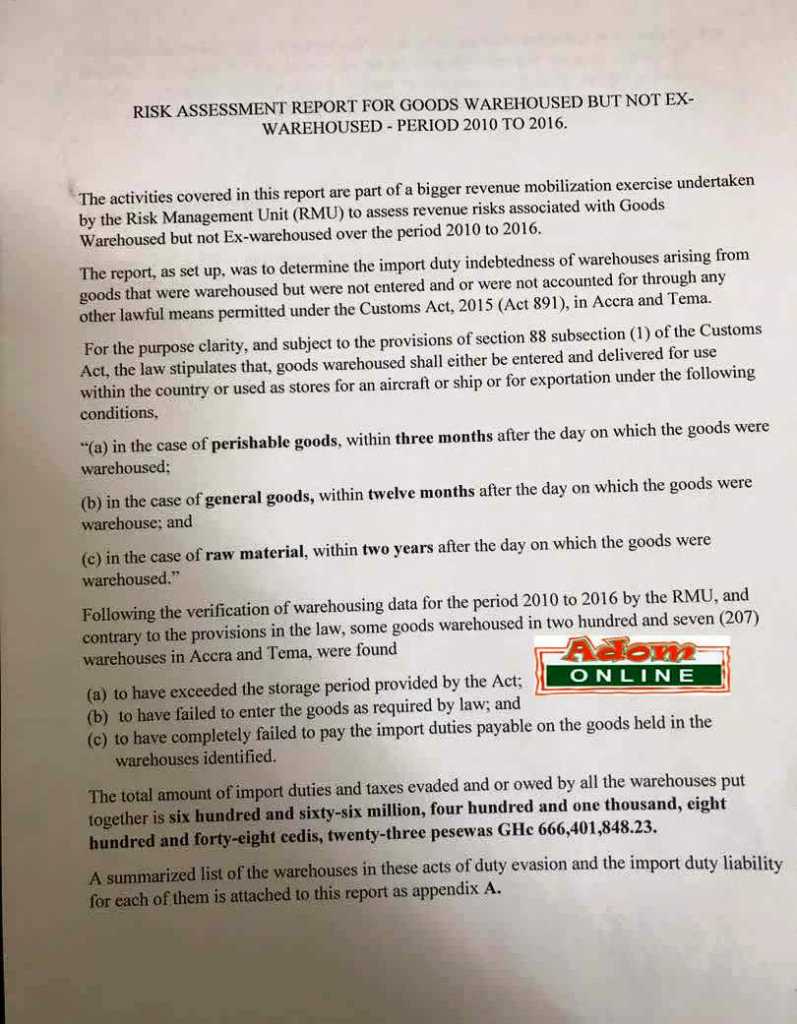

The host of Adom FM’s anti-corruption segment, Fabewoso, has revealed some 207 companies that keep their imported products in bonded warehouses have evaded import duties and tax payments to the tune of GH¢666,401,848.23.

The host said some of the companies cited for the tax evasion offences were pharmaceuticals, rice and sugar imports, automobiles, building materials and general goods, among others.

READ ALSO: Three dead in accident at Oboho

He mentioned a company called Sucatrade Limited which evaded 147,741,590.02 and later filed for bankruptcy and left Ghana.

Also, documents cited by Adomonline.com from the Ghana Revenue Authority (GRA) said: “Following the verification of warehousing data for the period 2010 to 2016 by the Risk Management Unit (RMU), and contrary to the provisions in the law, some goods warehoused in 207 warehouses in Accra and Tema were found to have exceeded the storage period, failed to enter the goods as required by law and completely failed to pay the import duties payable on the goods held in the warehouses identified.”

READ ALSO: We’re doing in 20 months what hasn’t been done in 61 years – Bawumia

After investigations, the GRA recommended that, as a deterrent that is consistent with the provisions of section 121, subsections (2) and (3) of the Customs Act, each company should pay a 300 percent pecuniary penalty as punishment for each of the warehouses involved to forestall the recurrence of similar acts commission.

READ ALSO: Ken Agyapong shoots down CSS report, calls it bogus [Audio]

Below is the document: